Proposition America: Pay for What You Get and Get What You Pay

For

Frank F. Bille

[A book self-published by the author, 1982 -- Part 1

of 3]

The following reprint of Mr.

Bille's book repeats the author's use -- for purposes of

emphasis -- of terms and phrases in full capitalization.

|

Is it not becoming more and more evident that there must be something

FUNDAMENTALLY WRONG with the economic systems of the world?

Not only do the socialistic and communistic countries suffer from

terrible oppression and under-utilization of human and natural

potentials, with chronic shortage of food and consumer goods; but the

so-called "capitalistic" nations also struggle with enormous

difficulties in coping with the problems of INFLATION, UNEMPLOYMENT,

HOUSING SHORTAGE, and a rapidly rising number of POVERTY-STRICKEN

PEOPLE who must be supported by the governments at TAXPAYERS' EXPENSE.

Here in America, the high cost of HOUSING, FOOD, GASOLINE, INSURANCE

and TAXES, which the hard working people must pay, is obviously

detrimental to the American Way Of Life, DEMORALIZING to young couples

who want to raise children, AGONIZING to the old folks with fixed

dollar incomes, DESTRUCTIVE to the nation's moral fibre, and

DISASTROUS to the nation's internal and external SECURITY.

The purpose of this book is to show that these tragic circumstances

are the results of FALLACIOUS DOCTRINES of economics which are of

ancient origin; PRECEPTS OF MEN contrary to the will of God but

perpetuated through many centuries, wrecking nation after nation,

kingdom after kingdom all through recorded history.

The rise and imminent DECLINE of the magnificent AMERICAN

CIVILIZATION follows the same pattern as that of the Roman Empire, the

Spanish, the Chinese, the Russian and the British Empires. In all of

these civilizations there existed an adverse economic condition which

slowly but steadily eroded their strength and made them vulnerable to

internal and external enemies.

According to reliable statistics the NON-PRODUCTIVE labor force of

America which in 1944 was one-third of the whole force has now in 1982

risen to two-thirds; the PRODUCTIVE labor force having been reduced

from two-thirds to one-third. America is losing her place as the most

productive and prosperous, peaceful nation in the world.

While the number of millionaires in America is growing rapidly, the

number of unemployed, poor, dependent people is growing much faster.

The number of property owners is declining while the number of renters

is increasing. And the government is going bankrupt!

WHY IS IT THAT THE MAJORITY OF PEOPLE BECOME POORER, AND A MINORITY

BECOME RICHER WHILK THE TECHNOLOGICAL PROGRESS IS OF ENORMOUS BENEFIT

TO INDUSTRY, COMMERCE AND COMMUNICATION?

IS UNEMPLOYMENT AND POVERTY A NATURAL CONDITION?

The explanations given by today's economists are utterly confusing

and leave US the citizens little hope of betterment. The one great

American economist whose name will be given later in this book

provided us with the REMEDY a hundred years ago. Because this man has

been so thoroughly misrepresented, ignored and maligned, to mention

his name at this point would be to conjure up all the prejudice and

professional ignorance accumulated through a century of

misinformation.

As a true PATRIOT you are anxiously engaged in a good cause and would

like to know exactly what's wrong with the American economy so that

you could base your POLITICAL OPINION on facts. You would want to have

an answer convincing to you as an educated person trained in making

logical conclusions; convincing to you as an honest person who abhors

all injustice. You would want a simple, clear-cut, unsophisticated

explanation which could be understood, adopted and acted upon by the

majority of the American people. Most of you good Americans would also

want an answer that is convincing to you as a CHRISTIAN whose life is

governed by obedience to the LAWS OF GOD.

Whatever the truth is, it must be the same no matter what criterion

is applied to it.

THERE IS SUCH AN ANSWER!

PROPOSITION AMERICA gives you the simple, straightforward answer to a

long list of perplexing economic problems and provides every American

Patriot with a solution and a course of political action which has the

power to solve practically all of the economic problems

SIMULTANEOUSLY. This is possible because the problems have a COMMON

CAUSE. When the FUNDAMENTAL FALLACY is corrected, a multitude of

SOCIAL, ECONOMIC and POLITICAL problems are automatically solved.

The REMEDY is TRUE CAPITALISM, which is expressed in the subtitle:

Proposition America: PAY FOR WHAT YOU GET AND GET WHAT YOU PAY FOR.

The COMMON but little understood CAUSE of universal economic trouble

is that mankind has disregarded the instructions which the Maker of

Heaven and Earth provided for the users of His Product, the earth. But

when all else fails, then perhaps we will READ THE INSTRUCTIONS and do

something about it.

We have violated the fundamental economic principle and the natural

law decreed by the Creator, the law upon which the Lord's promise of

material BLESSINGS are PREDICATED. It is impossible for the Lord to

secure to us His endless blessings when we disregard His all knowing

and wise instructions on HOW TO ADMINISTER His gifts of love.

The Fundamental Economic Principle which we have disregarded is THE

PRINCIPLE OF PROPERTY RIGHT, and the specific Law of God which is

clearly stated in the BIBLE but has been systematically ignored is THE

LAW OF LIBERTY.

From these violations spring the CURSES of unemployment,

underemployment, poverty, lack of housing, lack of food, lack of

education, lack of freedom, economic slavery, oppressive and wasteful

government and excessive taxation, enormous public and private debts,

inflation and bankruptcy of individuals, businesses and of public

entities such as New York City.

There is only one course of action which can carry the American

nation forward towards the cherished condition of GENERAL PROSPERITY

with LIBERTY AND JUSTICE FOR ALL, and which can save US from being

destroyed by internal and external enemies:

UNDERSTAND AND APPLY THE FUNDAMENTAL PRINCIPLES OF

PROPERTY RIGHT AND THE FUNDAMENTAL PRINCIPLES OF THE LAW OF LIBERTY

The economic and political ORDER which would arise on these premises

could be termed TRUE CAPITALISM as contrasted with the present mixture

of FALSE Capitalism, socialism, communism, atheism and materialism.

PROSPERITY would be within everybody's reach, and the LIBERTY of

citizens would be restricted only by the equal rights of all others.

PROPOSITION AMERICA is meant to show, point for point, that this

program is not an impossible dream; that our present so-called "capitalistic"

system is an un-scientific, unnatural, self-destructive mixture of

truths, half-truths and fallacies which will ultimately cause the

destruction of the American Nation if we do not put a halt to it.

There are only these two alternatives, self-destruction or redemption.

America's destiny is to lead the world in righteousness first,

prosperity and peace being the natural consequences thereof. Ancient

prophets have described America as "a land choice above all other

lands" and have stated categorically that this choice land must

be inhabited by righteous people who, if they become "ripe in

their iniquity", will be destroyed.

PROPOSITION AMERICA is not based on a theory concocted by politicians

as the result of an opinion poll. It is not of human origin, and this

writer takes no credit for it. It is based on one single PRINCIPLE,

which is of God and which cannot be disputed, the principle of

PROPERTY RIGHT. The Kingdom of God is governed by sacred laws. If the

principle of property right were not a sacred law the commandment that

"Thou Shalt Not Steal" and "Thou Shalt Not Covet"

would be meaningless.

PROPOSITION AMERICA'S aim is to restore to the American people all

the RIGHTS, PRIVILEGES and BLESSINGS which the Lord God intended for

us to have, and the key to all this is the God-given principle of

Property Right, which is a far cry from that which by the precepts of

men is called "property right."

Many of the good causes for which a multitude of fine American

Patriots are willing to spend their lives would automatically be

fulfilled if PROPOSITION AMERICA were enacted. Therefore, if our

Patriots will endorse this ONE GOOD CAUSE, all the scattered and often

fruitless efforts to save our country from a multitude of dangers will

combine into ONE FORMIDABLE POLITICAL FORCE FOR GOOD, and America will

fulfill her destiny.

PROPOSITION AMERICA, when endorsed by the people and made the LAW OF

THE LAND by act of the Congress, will have far reaching, beneficial

effects on the American economy.

There will be NO MORE INCOME TAXES, NO SALES TAXES, NO BUILDING

TAXES, NO IMPORT DUTIES, NO INHERITANCE TAXES.

In fact, ALL TAXATION of the products of human labor and industry

will be ABOLISHED.

YET, all levels of government will have AMPLE REVENUE with which to

carry out their LEGITIMATE FUNCTION, which is to SECURE JUSTICE by

PREVENTING INJUSTICE. This revenue arises, without taxation, from the

nation's COMMON HERITAGE, the free gifts of God.

GROUND DUTY is the appropriate name for this PUBLIC REVENUE which

will replace all taxation. It is paid by all who partake of the

UNEARNED BENEFITS arising from NATURAL RESOURCES, in proportion to the

VALUE of their LAND HOLDINGS. It is called a DUTY because they OWE it

to the COMMUNITY. The existence of this natural, equitable SOURCE of

public revenue has been carefully concealed by the powers which rule

the world, the powers which are responsible for the UNNATURAL,

INIQUITOUS economic conditions just described.

These evil powers are appropriately referred to as MAMMON, and this

book is an appeal to the greater powers which are known to exist, the

powers bestowed upon those of us who will not knowingly serve the

false god Mammon.

Since the concept of Ground Duty is unknown to most Americans it is

necessary to give it careful explanation, which will be given

throughout this book.

The Federal, State and Local Governments will be reduced to the size

necessary for securing justice by preventing injustice. The functions

of each level of government will be sharply defined.

There will be FULL LOCAL AUTONOMY in all matters which can be handled

locally. Most government revenue will be collected by local

governments, and higher levels of government (State and Federal) will

be supported by APPORTIONMENT between local governments.

Governments will be organized and run in a business-like manner after

the example set by executives of successful American corporations.

Their responsibility will be to secure the greatest possible profit

from the assets entrusted to them, and to yield the greatest possible

DIVIDEND to their SHAREHOLDERS, the American people. Every citizen is

born a shareholder.

Unlimited FREE PRIVATE ENTERPRISE will provide unlimited employment

opportunities (unlimited because the natural opportunities are no

longer monopolized). Consequently, there will be no involuntary

unemployment and poverty. LABOR UNIONS will become OBSOLETE because

PRODUCTION is limited only by the number of workers available.

Employers will-compete with each other to get the best workers and

will have to offer the highest possible WAGES. Every person will have

an opportunity to develop MB TALENTS to the highest degree.

The blessings and joy of HOME OWNERSHIP and a happy family life will

be within everybody's economic means.

There will be NO INFLATION, no recessions or depressions. PRODUCTION

will rise to the limit of the nation's capacity, causing PRICES of

goods to be SLOWLY FALLING while WAGES are stabilized.

The nation's MONEY SUPPLY will be created and OWNED by the national

government through MONETIZATION of the interest-free national CREDIT,

which is the credit given to the nation by all the money-holders in

common, i. e. the people.

The NATIONAL DEBT will be ELIMINATED, and no new national debt will

arise.

PRIVATE DEBT will be greatly reduced because title to land can be

acquired without purchase price but on condition of paying the annual

land rent called GROUND DUTY to the local government.

The secondary effects on the nation's cultural and social life will

be immense.

The nation's economic strength will greatly increase our MILITARY

STRENGTH and preparedness. Our prosperity will be of our own making

and not at other nations' expense. We will still not have any reason

for trying to dominate other nations, and our strength will be a

deterrent to the aggressors.

The government will no longer have a. mandate to extend "Foreign

Aid" or any other form of handouts to anybody. "Public

Welfare" payments will cease, and the responsibility for taking

care of the underprivileged, the sick and the needy will rest upon the

individuals, the family and the charitable organizations formed for

that purpose. Local government welfare assistance will be last resort.

The SOCIAL SECURITY System will be phased out, and the responsibility

for securing a retirement fund will eventually rest upon the

individuals themselves. However, it is expected that the GROUND DUTY

FUND will yield a SURPLUS which can be distributed either as a

DIVIDEND or as an old age PENSION.

All citizens will automatically be INSURED against economic losses

which may befall them due to natural calamities such as fire, floods,

earthquakes, untimely deaths, epidemics, etc. , or accidents. All such

losses not due to any fault of your own will be re-compensated to you

out of the GROUND DUTY INSURANCE FUND. There will be NO PREMIUM to

pay, for the Ground Duty is the premium.

At this point of my "utopian" presentation my reader's

irritation may have reached the boiling point, and the next paragraph,

I warn you, may be "the last straw." But please read on! The

full explanation of these unbelievable statements will be given later.

Remember, our present economic system is an unnatural, cancerous

organism. Having grown up with the unnatural, the natural order seems

weird to us.

There will be an ELIMINATION OF FALSE CAPITAL:

When the owners of land (improved or unimproved) have to pay the full

Ground Duty to the local government they thereby LOSE all the UNEARNED

PROFIT arising from land ownership. They also lose the INVESTMENTS in

land because the land (apart from the improvements) can have NO MARKET

VALUE when no unearned profit can be gained therefrom. The "capital"

invested in land is referred to as FALSE CAPITAL.

Therefore, the land owners are entitled to a COMPENSATION for the

loss of false capital which, to them, is very much a real capital,

perhaps representing all their life savings.

The compensation to all the land owners for the false capital lost

will be distributed once and for all in the year of the "Jubilee"

in such a manner that every person retains for himself the same

percentage of his NET WORTH as all others do. NOBODY suffers any REAL

LOSS.

Details of this EQUALIZATION process will be given in a following

chapter.

On the following pages will be given the SCIENTIFIC FACTS on which

PROPOSITION AMERICA is founded, together with the MORAL, ETHICAL and

RELIGIOUS reasons why these reforms CAN and MUST become a reality. The

most compelling arguments for PROPOSITION AMERICA are found in the

BIBLE and other sacred literature.

Before going into details, let's look at the PRESENT SITUATION:

The PRICE INFLATION is getting worse (1981. The SHORTAGE OF HOUSING

is becoming desperate. It is almost impossible for the young couples

to buy their first home and expect to pay for it out of the

breadwinner's salary. HOUSE RENT runs as high as HALF of an ordinary

family income. UNEMPLOYMENT is high and rising. POVERTY is becoming

widespread. The NATIONAL DEBT is (1982) about to top the unimaginable

TRILLION DOLLAR mark, and INTEREST thereon is about ONE HUNDRED

BILLION dollars annually, to be paid by the taxpayers before anything

else can be paid for. High INTEREST RATES on loans make it next to

impossible for business and industry to expand and provide more jobs.

BANKRUPTCIES are becoming an epidemic. TAXES take away what the

inflation has left. INSURANCE PREMIUMS are painfully high. PRODUCTIVE

INVESTMENT is DOWN, while UNPRODUCTIVE INVESTMENT is UP. FOREIGN

COMPETITION is overtaking the American industry. FOREIGN INVESTORS buy

up American land and American industry. Etc. , etc.

Economists disagree between themselves, but most believe (1982) that

we are headed for a serious, if not catastrophic, breakdown of our

economy. There is a real possibility that the inflation will run wild

and render the dollar worthless, throwing the nation into chaos, in

spite of anything the Reagan Administration can do. The President said

in his speech on February 18, 1981: "There is nothing wrong with

America that we, acting together, cannot fix. "True, provided --

of course -- that we KNOW what's wrong. That's the PROBLEM! The nation

is not being informed of the FUNDAMENTAL EVIL that is wrecking

America. Basic economic principles are not being taught in our

institutes of learning, and though it is basically a RELIGIOUS and

MORAL matter, no theologian is teaching it, no preacher is preaching

it. Anybody who brings up the subject is usually ignored, or else he

is ridiculed and in various ways effectively silenced.

STOP AND THINK!

IS IT NOT STRANGE that our combined DEBTS, public and private, have

risen to an astronomical amount which EXCEEDS the total amount of ALL

WEALTH owned by the American people and governments combined?

IS IT NOT STRANGE that you automatically OWE Uncle Sam an extra

amount of dollars whenever you have made an extra effort to support

yourself and your family; while, conversely, if you wasted your time

and talents you may be eligible for an AWARD from the same U. S.?

IS IT NOT STRANGE that we must pay $50,000.00 to $100,000.00 for an

ordinary, vacant residential lot, which the Lord God created and gave

us FREE ?

IS IT NOT STRANGE that MONEY comes into existence whenever someone

signs a note secured by real estate or wealth and hands the note to a

bank; and that, on the other hand, money is EXTINGUISHED when the LOAN

is paid off?

PERHAPS you have ready answers to these questions. Please write down

your answers. After reading PROPOSITION AMERICA, please see the notes

again.

We Americans believe in "Government of the people, by the

people, for the people. "The Founding Fathers believed that a

well informed, righteous electorate would produce well informed,

righteous lawmakers who would make just laws beneficial to the people

as well as the nation. They were inspired to formulate our

CONSTITUTION which for two centuries has guided the American nation to

the highest position of liberty, prosperity and power ever experienced

by any nation on Earth.

Then HOW did we get trapped in this economic quagmire? HOW is it

possible that a nation so wealthy, so powerful and possessing the

world's finest constitution is about to go bankrupt and commit

economic suicide?

The answer is that the Constitution, great as it is, does NOT define

the fundamental economic principle without which our Pledge of

Allegiance to One Nation, under God, with LIBERTY AND JUSTICE FOR ALL,

becomes merely rhetoric.

AS A FORMALITY, we the people are still invited to express our

opinions and preferences. Thank God for that!

But before BIG BROTHER cuts us off and makes it completely impossible

for us the people to even attempt to GOVERN OURSELVES, let us FACE

REALITIES and get down to BASICS! Until we the Electorate understand

and apply the basic economic principles we will continue to be

manipulated by the politicians who are forever trying to satisfy this

or that special interest lobby. We can be manipulated because we do

not have any STANDARD by which we can judge the Tightness or wrongness

of laws dealing with matters of economics.

PROPOSITION AMERICA sets up such an unfailing standard.

Unless this standard is applied, nothing can save America from going

the way of the Roman Empire which destroyed itself because of its

iniquitous ECONOMIC IMBALANCE.

THE SCIENCE OF PROPERTY RIGHT

There are two fundamental economic principles, the POSITIVE and the

NEGATIVE economic principles.

The POSITIVE economic principle: EVERY OBJECT UNDER THE

SUN HAS A RIGHTFUL OWNER

This is the principle of ECONOMIC BALANCE, BLESSINGS, PEACE

PROSPERITY, HARMONY, LIBERTY, FREE ENTERPRISE, FULL EMPLOYMENT, and

fulfillment of man's mission on Earth.

The RIGHT OF OWNERSHIP, in terms of Political Science, is called

TITLE and can be obtained, scientifically and ethically, in the

following three ways only:

- TITLE can be established by MAKING the object, creating an

ORIGINAL TITLE.

- TITLE to the object can be established by GIFT, GRANT or

INHERITANCE from the titleholder. This will be a TRANSFERRED

TITLE.

- TITLE can be established by EXCHANGE between FREE MEN acting

with COMMON CONSENT of objects to which each party, respectively,

has an original or transferred title.

PROPERTY RIGHT according to the POSITIVE ECONOMIC PRINCIPLE is an

UNIVERSAL PRINCIPLE which the Lord God himself honors in all His

dealings with men. His commandment "Thou Shalt Not Steal" is

predicated upon the principle of true property right, without which

the commandment would be meaningless.

The NEGATIVE economic principle:

ANY CLAIM TO OWNERSHIP OF AN OBJECT WHICH THE CLAIMANT HAS NOT

AQUIRED BY EITHER

- MAKING IT

- OR BY GIFT, GRANT OR INHERITANCE FROM TRUE TITLEHOLDER

- OR RECEIVED IN EXCHANGE FOR AN OBJECT OF EQUAL VALUE

IS A DISTURBANCE OF NATURAL ECONOMIC BALANCE AND A VIOLATION OF THE

UNIVERSAL LAW OF GOD: THOU SHALT NOT STEAL

The NEGATIVE ECONOMIC PRINCIPLE is the principle of ECONOMIC

IMBALANCE, which evokes confusion, poverty, unemployment, riots, wars,

disease and wretchedness, and the CURSE of God.

PROPOSITION AMERICA proposes to RESTORE the POSITIVE ECONOMIC

PRINCIPLE in all matters of economics, by causing the American People

to abandon all acts governed by the Negative Economic Principle. In

other words: STOP STEALING!

At first thought, that doesn't seem very far fetched. We don't steal!

What we meant to say was: STOP LEGAL STEALING!

At second thought, that's another matter.

Let us simplify the matter by stating the simple philosophy of TRUE

CAPITALISM: PAY FOR WHAT YOU GET, AND GET WHAT YOU PAY FOR. That's all

there is to it!

If we stick to that axiom we can put America on its feet again. And,

honestly, does that sound too hard? Presumably not.

THE DISTRIBUTION OF WEALTH

PRODUCTION of goods and services in abundance is what makes the

American nation so wealthy. We possess all the FACTORS necessary for

an even greater abundance of wealth. But we have LOST the ability to

make full use of these economic factors.

The term WEALTH comprises CONSUMER GOODS and CAPITAL GOODS. Wealth is

everything which is PRODUCED by LABOR and CAPITAL and which has an

ECONOMIC VALUE. The term VALUE means DESIRABILITY and is measured by

the amount of EXERTION which people are willing to give IN EXCHANGE

for the object, in the MARKET PLACE. SERVICES can be defined as "Wealth

instantly produced and consumed."

The Three Factors of Production

There are three FACTORS OF PRODUCTION: LAND, LABOR and CAPITAL.

LAND is the scientific economic term for ALL NATURAL RESOURCES.

LABOR is the scientific economic term for PEOPLE who exert their

ENERGY and TALENTS in any way whereby they produce goods or services

of VALUE to mankind.

CAPITAL is the scientific economic term for that part of the nation's

WEALTH which is set aside for the purpose of AIDING LABOR in the

PRODUCTION OF MORE WEALTH. It includes wealth which is not yet in the

hands of the consumers but is still in the process of EXCHANGE.

Capital is, so to speak "Labor transformed into a more efficient

form."

The Three Channels of Wealth Distribution

The PRODUCT is DISTRIBUTED by the means of EXCHANGE, to the OWNERS of

Land, Labor and Capital, through three CHANNELS OF DISTRIBUTION: RENT,

WAGES and INTEREST.

The owners of LAND receive RENT for the use of their land. RENT,

properly called LAND RENT as distinct from rent of buildings and other

man-made things, is the UNEARNED INCOME arising from land. "Unearned"

because it arises either from the natural bounty of the land or from

the LOCATION VALUE. In either case, land rent is that part of the

product which exceeds the expenditure of wages and interest.

The workers, LABOR, receive WAGES for their efforts Wages are the

EARNED INCOME or benefits arising from labor of any sort, mental or

manual, whether paid in money or in any other form.

The owners of CAPITAL ("Capitalists" are workers who have

stored up results of their labors for a more efficient use) receive

INTEREST, which, in the true sense of the word, is a form of WAGES for

their stored-up labor. True INTEREST is, therefore, an EARNED INCOME.

THE POSITIVE ECONOMIC PRINCIPLE APPLIED TO THE DISTRIBUTION OF

WEALTH

In spite of all scientific evidence, in spite of all scriptural

evidence and in spite of logic and moral considerations, the "establishment",

i.e. the powers ruling the world, has consistently disregarded the

fact that natural resources, the economic factor number one, LAND, is

NOT the property of men.

THERE IS ONLY ONE, GREAT LANDLORD: THE LORD GOD ALMIGHTY

HIMSELF

The POSITIVE ECONOMIC PRINCIPLE states that THE MAKER has the TITLE.

The Lord made the earth, therefore He has the title to it. The Bible

confirms this scientific fact:

"The earth is the LORD'S, and the fulness thereof,

the world and they that dwell therein. For he hath founded it upon

the seas, and established it upon the floods. " (Psalms 24:1-2)

The Bible also declares:

"The heaven, even the heavens, are the LORD'S: but

the earth hath he given to the children of men. " (Psalms

115:16)

Does the Lord contradict himself when He claims title to something He

has given away? Do the "children of men" actually own the

earth now that He has given it to them? NO. what the Lord has given to

the children of men is NOT the earth itself but the RIGHT TO EXIST on

the earth and use its NATURAL RESOURCES, on certain CONDITIONS. He did

not sell it to US, He LEASED it. Moreover, since the Lord is not a

respector of persons, He did not grant any special favors to anybody.

Everybody has an EQUAL RIGHT to exist on this earth without having to

pay another person for that privilege. That is the ESSENCE of the LAW

OF LIBERTY. That is OUR GOD-GIVEN INHERITANCE.

Each of the Children of Israel who received the LAW OF LIBERTY was

GRANTED a portion of the LAND as a LEASEHOLD, but this INHERITANCE was

CONDITIONAL. They were to obey certain COMMANDMENTS, or else they

would LOSE their INHERITANCE.

"THE LAND SHALL NOT BE SOLD FOREVER: FOR THE LAND IS

MINE; FOR YE ARE STRANGERS AND SOJOURNERS WITH ME. " (Leviticus

25:23)

This is a clear statement that God is THE GREAT LANDLORD and that MAN

is His TENANT.

As a TENANT, man is required to pay THE GREAT LANDLORD his RENT, in

the Bible called TITHE because it is one-tenth of man's INCREASE

derived from his LABOR on his INHERITANCE.

The Israelites paid the tithe to the Lord, and the Lord used the

revenue to pay the WAGES of His servants, the priestly tribe of LEVI.

To the Levites, the tithe constituted THEIR INHERITANCE, for they were

NOT granted a landed inheritance such as the other tribes.

AND, BEHOLD, I HAVE GIVEN THE CHILDREN OF LEVI ALL THE

TENTH IN ISRAEL FOR AN INHERITANCE, FOR THEIR SERVICES WHICH THEY

SERVE, EVEN THE SERVICE OF THE TABERNACLE OF THE CONGREGATION . . .

... IT SHALL BE A STATUTE FOR EVER THROUGHOUT YOUR GENERATIONS THAT

AMONG THE CHILDREN OF ISRAEL THEY SHALL HAVE NO INHERITANCE (Numbers

18:21-23)

According to the COVENANT which the Israelites made with the Lord the

tithe was clearly a contractual payment for benefits received. It was

clearly a LAND RENT. The Israelites paid the Lord for two different

kinds of BENEFITS. Life itself, and the God-given TALENTS bestowed on

the individual was one of the benefits. The God-granted landed

inheritance was the other benefit. We may refer to the tithe as "Soul-and

Land RENT. "

Under the contract (covenant) which they made with the Lord, the

Israelites could not sell their land forever (in perpetuity), for the

land belongs to the Lord. But they could sell it as a SUB-LEASEHOLD

for periods of up to fifty years at a time, after which the land would

REVERT to the man whose INHERITANCE it was, free of charge, in the

year of the JUBILEE.

The LEASEHOLDER would pay a LAND RENT, either as a lump sum once and

for all or as an annual charge:

ACCORDING TO THE NUMBER OF YEARS AFTER THE JUBILEE THOU

SHALT BUY OF THY NEIGHBOR, AND ACCORDING UNTO THE NUMBER OF YEARS OF

THE FRUITS HE SHALL SELL UNTO THEE: ACCORDING TO THE MULTITUDE OF

YEARS THOU SHALT INCREASE THE PRICE THEREOF, AND ACCORDING TO THE

FEWNESS OF YEARS THOU SHALT DIMINISH THE PRICE OF IT: FOR ACCORDING

TO THE NUMBER OF YEARS OF THE FRUITS DOTH HE SELL UNTO YOU

(Leviticus 25:15-16)

If an Israelite decided to become a merchant, sailor, carpenter or

anything for which he did not need his acres, he could in this way

LEASE his land to someone else and continue to receive the UN-EARNED,

God-given income from his INALIENABLE INHERITANCE while devoting his

time and energy to his trade. But he could not sell his land outright

the way we do today, for that would DEPRIVE HIS CHILDREN of their

inheritance when the money was gone. And nobody would have to make any

DEBT in order to gain access to LAND. The land rent was paid out of

CURRENT INCOME from the land. In contrast, the PRICE we pay for land

today is the CAPITALIZED, FUTURE LAND RENT, and MORTGAGE DEBTS are

putting not only ourselves but our posterity into economic SLAVERY.

The Israelites eventually lost their inheritance because they

VIOLATED the LAW OF LIBERTY. They adopted the idolatrous ways of the

false god BAAL and began to buy and sell land outright, ignoring the

law of REDEMPTION commanded by the Lord:

AND YE SHALL HALLOW THE FIFTIETH YEAR AND PROCLAIM

LIBERTY THROUGHOUT ALL THE LAND UNTO ALL THE INHABIT ANTS THEREOF:

IT SHALL BE A JUBILEE UNTO YOU; AND YE SHALL RETURN EVERY MAN UNTO

HIS POSSESSION AND YE SHALL RETURN EVERY MAN UNTO HIS FAMILY

(Leviticus 25:10)

Please read the entire chapters 25 and 26 to get the full scope of

this tremendously important LAW OF LIBERTY.

We too are violating the Lord's commandment in thinking that we can

own the land and that we can buy and sell for a PRICE like

merchandise. Therefore, WE are NOT receiving the BLESSINGS which were

PREDICATED upon keeping the Lord's commandments. Not that the Lord is

arbitrarily punishing us in revenge; we bring upon ourselves the

natural CONSEQUENCES of UPSETTING THE NATURAL ECONOMIC BALANCE when

some of us get something for nothing while others get nothing for

something. We are applying the NEGATIVE ECONOMIC PRINCIPLE to our

dealings in LAND.

PROPOSITION AMERICA will simply re-instate our BIRTHRIGHT and RESTORE

our long lost EQUAL, INALIENABLE INHERITANCE by adhering to the

PRINCIPLES of the LAW OF LIBERTY.

We cannot use the METHOD employed by the Israelites. We cannot

distribute the land to everybody in equally valuable parcels, but we

can do what is even better. We can distribute the LAND RENT, i.e. the

unearned income from land, which arises partly from the God-given,

inherent qualities of the land and partly from the benefits of a well

organized society, benefits which create LOCATION VALUES.

Since the God-given, inherent qualities of the land are bestowed

EQUALLY to all men, and since the location values are created by us

all IN COMMON, the total land value, or ANNUAL LAND RENT, is clearly

the COMMON PROPERTY of us all according to the POSITIVE ECONOMIC

PRINCIPLE.

In keeping with the LAW OF LIBERTY, this common property should be

collected by the COMMUNITY in the form of a GROUND DUTY and be

distributed equally to all persons in the community where it is

produced. Each person would in this way receive his God-given,

un-earned income or INHERITANCE, exactly as each Israelite did when he

leased his inheritance to someone else.

HOWEVER:

The community (city, county, state, nation) also has COMMON EXPENSES.

The city and county provide streets, sewers, schools, police, fire

protection etc. The state provides freeways, courts, universities,

harbors, etc. The Federal Government provides defense, courts, foreign

relations, national parks, etc.

As a matter of fact, the VALUE (desirability) of the land arises as a

RESULT of all these beneficial PUBLIC WORKS, SERVICES and ACTIVITIES

which serve to secure our possessions, enhance our economic

possibilities and enrich our lives as workers, businessmen and

residents. Also all the beneficial activities of the people in our

various capacities contribute in a large measure to making the land

valuable.

The commonly owned GROUND DUTY FUND collected from all us land

holders according to the value of our land holdings is the natural

fund from which ALL LEGITIMATE PUBLIC EXPENSES could be disbursed.

Then only the SURPLUS of the people's equal inheritance would be

distributed to the citizens.

The WELL MANAGED PUBLIC SECTOR, in cooperation with a well managed

PRIVATE SECTOR, would greatly ENHANCE the property values and ENLARGE

the GROUND DUTY, while simultaneously keeping the expenses down. The

result would be a greater surplus which could be paid out as a

DIVIDEND to the SHAREHOLDERS, that is, all the citizens of that

community.

Liberation from taxation

With FULL GROUND DUTY in effect, this public revenue will be

immensely large while simultaneously the cost of ADMINISTRATION will

be immensely simplified. Therefore we can ABOLISH all taxes on the

products of human labor: INCOME TAXES, SALES TAXES, PROPERTY TAXES ON

BUILDINGS, etc.

The GROUND DUTY is NOT a tax but a duty.

Free public insurance

Besides taxes, also most INSURANCE PREMIUMS can be abolished. The

Ground Duty Fund will pay the citizens a COMPENSATION for all DAMAGE

from natural causes (fire, flood, earthquake, etc.), from acts of

criminals and from any other calamity not due to any fault of the

individual. There is NO PREMIUM to pay, for the GROUND DUTY is the

premium.

Equalization of nominal losses

Of course, when the un-earned income from all land is collected by

local governments from the owners of land the owners LOSE the WHOLE

AMOUNT they have invested in land since the PRICE OF LAND is

determined by the UN-EARNED PROFIT which the titleholders expect to

derive from their land. The landholders are entitled to receive a

COMPENSATION for their LOSS of FALSE CAPITAL.

PROPOSITION AMERICA provides for an EQUALIZATION of these nominal

losses in such a way that NOBODY LOSES but all gain. See the chapter

on Equalization.

To avoid misunderstanding, let us make it absolutely clear that you

can BUY AND SELL PROPERTY exactly AS NOW. You take TITLE to land and

improvements exactly as now, the only difference being that THE LAND

COSTS YOU NOTHING, only the IMPROVEMENTS have to be paid for. But then

you must pay the annual GROUND DUTY for the land while the buildings

and improvements are TAX FREE.

You pay full Ground Duty whether the land is vacant or developed.

YOU PAY FOR WHAT YOU GET AND GET WHAT YOU PAY FOR.

You pay the community for the value which the Lord and the community

have bestowed upon the lot, and you pay the carpenters, electricians

and other contractors for the beautiful house they build for you. If

you leave the land vacant, the Lord and the community are bestowing

the value on it IN VAIN unless you pay the Ground Duty, and till you

do develop the land YOU are paying the Ground Duty IN VAIN and have NO

PROFIT. Therefore, no valuable land will remain vacant or

underdeveloped for long. All valuable land will be put to THE HIGHEST

AND BEST USE, and the ensuing BUILDING BOOM will be limited only by

the availability of workers and materials. No more UNEMPLOYMENT!

There will, of course, still be land which is not needed at present.

Such land will become part of the PUBLIC DOMAIN which does not pay

Ground Duty but which is reserved for the use of FUTURE GENERATIONS.

Remember, it is NOT YOU who pays the Ground Duty. THE LAND pays the

Ground Duty if YOU make good use of it.

LAND MONOPOLY

THE ENEMY OF LABOR AND CAPITAL

The LAND MONOPOLY is the fundamental EVIL which is running US down.

We are all, more or less, either monopoly holders or victims of the

monopoly powers. And let us make it perfectly clear that neither the

monopoly holders nor the victims will like it when the madly

escalating ECONOMIC IMBALANCE is driven to the point where the great

majority of US must pay TWO THIRDS or THREE FOURTHS of our hard earned

income just for the RIGHT TO EXIST (in rents, taxes, insurance

premiums, etc.); when 99% of US are RENTERS and 1% of US are OWNERS.

There will be RIOTS and CIVIL DISORDERS far beyond the chaos we

already have (1982). Therefore, it is IN THE INTEREST of even the most

affluent person that the LAND MONOPOLY be ELIMINATED.

THE CHOICE before US today is between NATIONAL SUICIDE and NATIONAL

REVIVAL, and the latter alternative is possible only if we TURN AROUND

and try to live by the economic laws of God.

ECONOMIC BALANCE or EQUITY is the NATURAL ORDER which will replace

the economic imbalance or INIQUITY of the present if and when we begin

to obey God's commandments and permit true economic science to be

taught and to be acted upon politically.

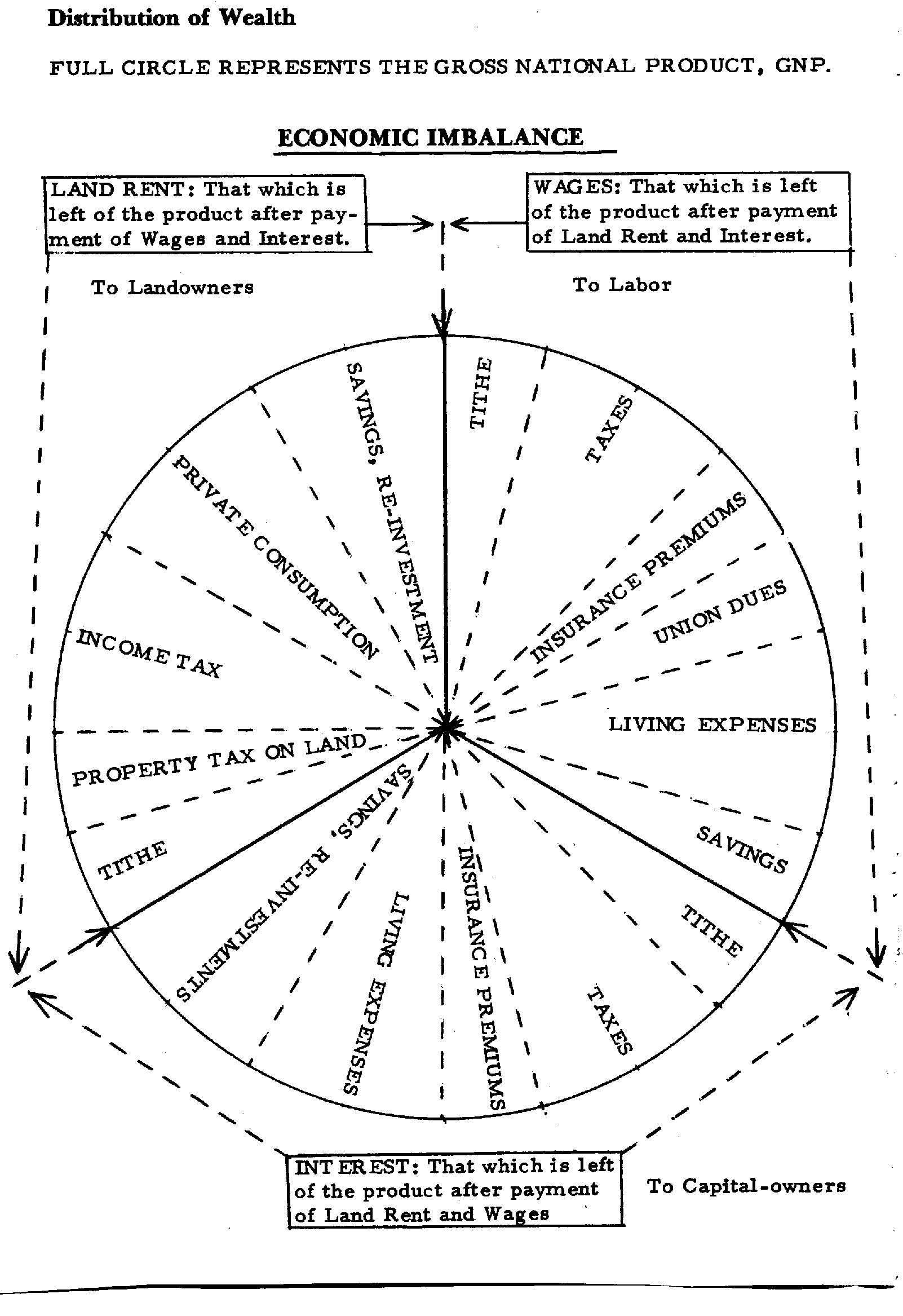

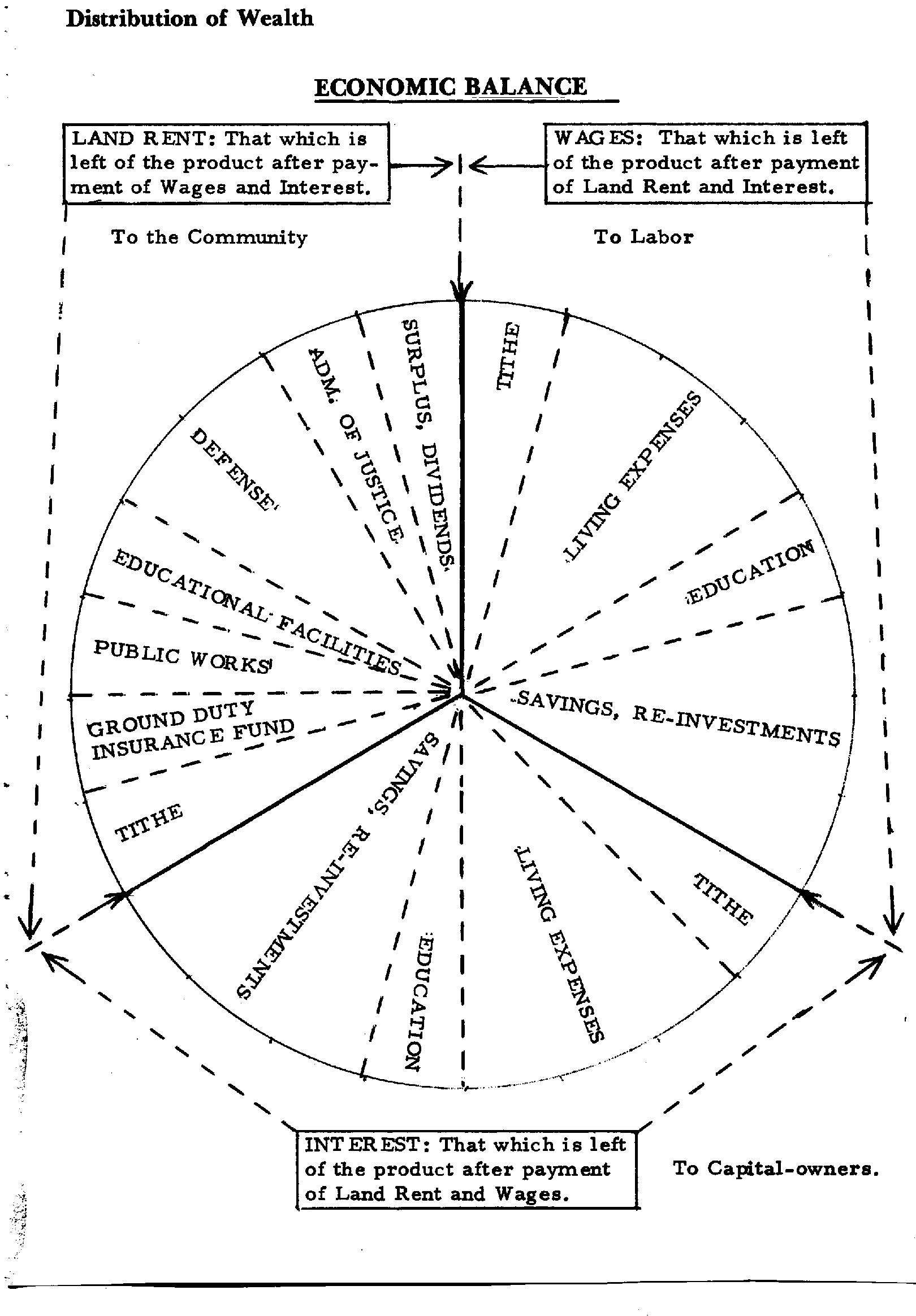

Our economy can be likened to a huge PIE which is being divided into

wedge-shaped pieces of various sizes. There are three main portions

representing the three CHANNELS of WEALTH DISTRIBUTION: LAND RENT,

WAGES and INTEREST. These three pieces are, in the illustration,

separated by heavy lines. The dotted lines indicate "the way the

pie is eaten. " The pie as a whole represents the TOTAL amount of

WEALTH and SERVICES produced in America in one year, the GROSS

NATIONAL PRODUCT (GNP). It is not a fixed quantity, and the size of

each slice relative to the size of other slices is subject to

VARIATIONS. It is important to visualize that, as the economy

develops, the whole pie will usually grow bigger, and also that a

proportional ENLARGEMENT of any one slice will cause a proportional

DIMINISHING of other slices. Thus, if for instance the slice taken by

TAXES grows disproportionately, the net revenue of Rent, Wages and

Interest diminishes.

Please bear in mind that the relative sizes of the slices in the

illustration in no way reflect statistical facts. It's the HOW and the

WHY we are interested in, not statistics.

The PIE will be cut according to the POWERS which control the three

economic factors, LAND, LABOR and CAPITAL. The more power, the bigger

the slice.

The LAND RENT is that part of the PRODUCT which is left after payment

of WAGES and INTEREST.

WAGES is that part of the product which is left after payment of the

LAND RENT and INTEREST.

INTEREST is that part of the product which is left after payment of

LAND RENT AND WAGES.

In other words, each of the three economic factors is exerting

political and economic POWER to secure for itself a greater slice of

the pie at the expense of the two others.

Unfortunately, due to the inherent ancient misconception of Property

Rights, the cards are stacked in favor of the Land Monopoly. Labor and

Capital must pay the Land Monopoly a rapidly increasing RANSOM for the

RIGHT TO EXIST and can expand only with difficulty because little is

left of their WAGES and INTEREST after paying these expenses. The

expansion of Capital must be done with funds derived from the Land

Monopoly, and the INTEREST RATES which Capital must pay are

necessarily HIGH because otherwise the funds would be invested in LAND

which yields a higher PROFIT than normally can be earned by

investments in capital (buildings, machinery, etc.)

The Land Monopoly exerts its power by keeping large tracts of land

VACANT or UNDERDEVELOPED, denying Labor and Capital access to the

natural resources necessary for all productive activity. The

landowners, as such, need only WAIT and nay the MINIMAL TAXES on the

land, while Labor and Capital starve for lack of opportunities they

can afford. Eventually, all land, all natural resources become

capitalized at such high ransoms that Labor and Capital cannot

function, and we have UNEMPLOYMENT, POVERTY, RECESSIONS and

DEPRESSIONS.

Here in America there was plenty of land to share in the beginning.

Therefore, the Land Monopoly had relatively little power, and the

slice of the Pie going to Labor and Capital was relatively large

compared to the Land Rent slice. The early settlers in America were

people who had escaped from the oppression of the Land Monopoly in

Europe. They found LIBERTY in America because they didn't have to pay

other men for the right to live and work on the land. And Labor and

Capital produced the world's greatest and richest nation. For a long

time, the Land Monopoly had relatively little power because of the

abundance of land, the Homesteading Law and the Property Tax which

channelled part of the Land Rent away from the landlords and into the

public treasuries where it belongs.

The PROPERTY TAX was originally a tax on LAND ONLY. Due to the

general confusion about Property Right, the DISTINCTION between LAND

and WEALTH became lost, and eventually the Property Tax was levied

equally on both land and wealth. Land was taxed less and less and

wealth was taxed more and more as INCOME TAXES, SALES TAXES and other

taxes on the products of human efforts replaced the Property Tax. That

development increased greatly the NET UN-EARNED PROFIT, the LAND RENT,

and the Land Monopoly has now grown to the point where the portions

left for WAGES and INTEREST are not just proportionally but ABSOLUTELY

being DIMINISHED. That point is where the wholesome GROWTH of the

whole PIE, the GNP, can no longer be sustained as more money is being

UNPRODUCTIVELY invested in LAND and less money is being PRODUCTIVELY

invested in LABOR and CAPITAL.

STOP AND THINK! Does a vacant lot on Wilshire Boulevard in Los

Angeles become more productive because a man in New York invests ten

million dollars in it? Is it not at least as productive if a Los

Angeles firm takes it over for nothing, puts a skyscraper on it and

starts paying Los Angeles City a million dollars a year in GROUND

DUTY?

LABOR AND CAPITAL feel the pinch and try to fight back the best they

can, but due to the confusion in economic theory, the power of the

LABOR UNIONS and the powers of the CAPITAL OWNERS are aimed at the

WRONG TARGETS. Instead of uniting their powers and fight the

monopolies they fight EACH OTHER because they do not understand the

fact that they are IN THE SAME BOAT!

STRIKES are directed at MANAGEMENT, and when the wage dispute is

settled and higher wages are being paid to LABOR, no greater amount of

WEALTH is being produced, but people have more MONEY to spend. That is

a signal for the LANDLORDS to raise the RENT, and soon the Land

Monopoly has eaten up the whole pay raise, necessitating another round

of strikes. The LANDLORD is making LAND and BUILDINGS available for

RENT, and the rent is raised when the SUPPLY of available land in that

general location falls short of the DEMAND. Therefore, most of the

INCREASE in rent translates into higher land PRICES.

The LAND-OWNER, as such, is completely PASSIVE and produces NOTHING.

He may live in New York and own land in California, from which he

draws his UN-EARNED INCOME. The people of California, with their

industry and co-operation, have created the land value and the land

rent and are therefore, according to the POSITIVE ECONOMIC PRINCIPLE,

the TRUE OWNERS of the land rent, which they don't get. So they must

pay income taxes, sales taxes, etc. to defray their public expenses,

while the landowner can take his un-earned income, pay some income tax

from it and INVEST the rest in more California land.

Our economy is becoming increasingly UNBALANCED because the LAND RENT

does not flow to the rightful owner. According to the POSITIVE

ECONOMIC PRINCIPLE, and according to the Lord's LAW OF LIBERTY, the

land rent belongs to all the people in common, or equally to each and

every person because land rent arises from, first, God's free and

equal gift of natural resources; second, the marvelous co-operation of

the people and the miraculous TECHNOLOGY, which make it possible for

the ordinary citizen to live in greater comfort, security, health and

luxury than any king in ages past. The technological SOCIETY or

COMMUNITY provides streets, highways, railways, airports, police,

fire-protection, courts, hospitals, churches, theatres, restaurants,

shopping centers, water, electricity, gas, telephone, radio,

television, libraries, parks, factories, schools, universities,

amusement parks, museums, etc. GOOD BUSINESS and GOOD EMPLOYMENT

OPPORTUNITIES come along with all these beneficial facilities and

institutions. Whether they are publicly or privately financed they all

together cause the DESIRABILITY, i.e. the VALUE of the land to rise.

In truth, the community EARNED the land rent but is getting only a

very small part thereof in the form of PROPERTY TAX ON LAND VALUES.

An uncalculable amount of money is WASTED because of our unbalanced

economy, A huge BUREAUCRACY arises because of the need for an

ARTIFICIAL BALANCING of the economy. A multitude of LAWS and

REGULATIONS and EXECUTIVE ORDERS must be put into effect in order to

help the individuals, the companies, the cities and even the poor

FOREIGN COUNTRIES which all have become the victims of an unbalanced

economy. And the TAXPAYERS must pay and pay till they run out of work

and money. Then THEY become entitled to a HANDOUT.

But the WORST WASTE is the waste of HUMANS. Lack of FREEDOM to use

the God-given OPPORTUNITIES causes waste of human intelligence and

human aspirations, dreams and longings, the SPIRITUAL GIFTS of God

which, if given a chance, would blossom and enrich our lives

materially, culturally and spiritually.

Just think of all the mothers who must leave their children all day

while they are working to supplement their husbands' income. Is there

any doubt that children need their mothers, and that this condition is

detrimental to Family Life?

The American Dream

Our great American free enterprise, "capitalistic" economy

did not happen by accident. There were spiritual as well as material

factors contributing to our success. The people who built up this

great nation were possessed with a wholesome attitude, aptly described

as "The American Ethic, "a blend of positive ideas both

pragmatic and religious, characterized by a sense of fairness,

tolerance, liberty and justice. As a result we became a classless

society in which most inhabitants were, at the same time, LANDOWNERS,

LABORERS and CAPITAL OWNERS, all three in one. In other words, most

Americans possessed to some degree their God-given share of the

natural resources, their INHERITANCE. And even if they were not owners

of land they received much of their natural BLESSINGS anyway as long

as land was abundantly available, RENT and PRICES were low, and WAGES

were comparatively high. With this came the gift of independence,

self-reliance, industriousness, generosity and PROSPERITY. There was,

and still is, enough land for everybody to share. The abundance of

cheap land spurred a rapid rate of growth. The political UNION and the

absence of trade barriers between the states (Free Trade) created the

most favorable climate for an unprecedented TECHNOLOGICAL DEVELOPMENT,

with MASS PRODUCTION bringing the technical wonders to the people at

prices which they could afford.

That was PROGRESS! THE AMERICAN DREAM!

The American Dream was badly disturbed in the 1930's when the GREAT

DEPRESSION hit the United States. The Land Monopoly and its offspring,

the Money Monopoly, had created a state of economic imbalance which

almost paralyzed the country. The Roosevelt Administration could have

restored full employment, prosperity and peace in a very short time by

applying the Positive Economic Principle. But instead of curing

injustice with justice, Roosevelt's "New Deal" rescued the

Money Monopoly and the Land Monopoly, which had just proven their

perverse nature; established BIG BROTHER GOVERNMENT with its

unmerciful TAX MONOPOLY, introduced SOCIALISM and the LABOR MONOPOLY

and created the WELFARE STATE.

The "New Deal," which pretends that government can perform

many tasks better than Free Enterprise can, was necessary because the

Land Monopoly and the Money Monopoly made it impossible for Labor and

Capital to function at full capacity and provide for the needs of ALL.

These un-natural, socialistic creations violate the God-given

principle of Property Right just as badly as the Land Monopoly and the

Money Monopoly do, but they serve to establish an ARTIFICIAL, though

UNSTABLE ECONOMIC BALANCE, a balance which is continuously upset by

the iniquitous POWERS operating within the system.

In fact, the "New Deal" served to magnify the powers of the

Land Monopoly and the Money Monopoly by forcing the victims of the

monopolies to share their means with each other, to the end that we

may all be alive and able to pay rent and make loans at usurious

interest rates. It goes without saying, that DEAD PEOPLE are of NO USE

to the monopolies.

IN SPITE of the monopolies and the "New Deal" America

proceeded victoriously and emerged from the Second World War stronger

and more prosperous than ever. But we are not so sure about the THIRD

WORLD WAR!

Now the "New Deal" has run its pernicious course and has

served to elevate the Land Monopoly and the Money Monopoly to the

point where the RANSOM we have to pay for the right to exist makes it

IMPOSSIBLE for us to maintain PRODUCTIVE investment and employment. No

matter WHAT the government tries to do, short of establishing Justice,

will only make matters worse.

More and more Americans are now deprived of the chance to become

owners of even a small lot with a house on it. All their income is

spent on RENTS, LIVING EXPENSES, TAXES and INSURANCE. Nothing is left

for the acquisition of either land or capital.

On the other hand, that portion of the population which holds LEGAL

TITLE to land (the Land Monopoly) has an ever growing SURPLUS. This

surplus is further enlarged when LAND VALUE TAXATION is being

DIMINISHED as when California's Proposition 13 was passed in 1978. And

when the INCOME TAX CUTS become effective in 1982, much of the tax

savings will be invested in land, further stimulating the PRICES.

This UNPRODUCTIVE INVESTMENT in land, whether the land is vacant or

developed, diminishes sharply the funds available for PRODUCTIVE

investment. The much needed factories, homes and office buildings etc.

remain unbuilt, and UNEMPLOYMENT gets worse.

If a FEDERAL SALES TAX, the so-called VALUE ADDED TAX (VAT) is

instituted to replace income taxes lost, the brunt of the burden will

be on the CONSUMER, further expanding the GAP between rich and poor.

That's THE END OF THE AMERICAN DREAM!

Perhaps the ugliest but least noticed consequence of the Land

Monopoly is ABSENTEE OWNERSHIP. Places which are abundantly bestowed

with natural resources such as coal, oil, minerals, timber, fertile

land, etc. , are often inhabited mostly by poor people who do not own

much of the land, with poorly financed local governments and schools.

Though they produce enormous amounts of wealth they receive no share

of the bountiful land rent. ABSENTEE OWNERS siphon away the LAND RENT,

while paying only a scant property tax and no income tax to the

community where the land rent is produced.

The astronomical land values of New York City yield too little to the

city government. The income tax on the unearned profits may be paid by

the absentee owners, but not to New York City. The welfare load is

huge, and that most wealthy city is BANKRUPT.

California's Imperial Valley is one of the country's most productive

agricultural areas. Big absentee landowners carry the land rent away,

and poor men do the labor.

Arab Oil Sheiks and Japanese Industrialists buy up large tracts of

land in America. There is nothing to prevent them from carrying off

the fruits of our God-given INHERITANCE, our common property, the land

rent, which we as a community have EARNED.

Higher rents, lack of employment and rising poverty force millions of

-Americans to become dependent on PUBLIC WELFARE. The government

spends billions upon billions of taxpayers' money on aid to the poor

but when the poor families get this extra money, UP GOES THE RENT. For

the rent is determined by what the market will bear. In the end, the

Land Monopoly soaks up all the "welfare" money, and the poor

are no better off. Then, instead of a cry for justice, up goes a cry

for RENT CONTROL. When rent control is in force, no new buildings will

be built unless heavily subsidized by the government, and the existing

apartment buildings will decay for lack of maintenance. Apartment

owners are often hard put because of the high price they have paid and

the high interest rate on mortgage loans.

The taxpayers are SUBSIDIZING the Land Monopoly in many other ways.

Perhaps the most astounding feat of the Land Monopoly is the great

success of REDEVELOPMENT AGENCIES. Private enterprise cannot eradicate

slums and rebuild decaying cities because the low property taxes make

it profitable for landlords to keep the land under-utilized while

waiting for the BIG BIDDER. The Redevelopment Agencies are such big

bidders. There was, for example, a triangular block about one and

one-half acre in size adjacent to the freeway near this town. The

owners were offered a total of $250,000 for it but would not sell.

Then the Redevelopment Agency took action. The block was condemned and

acquired by the RDA for $750,000 and resold to a hotel chain for

$250,000, with a LOSS of half a million dollars, which loss is to be

borne by the taxpayers. The "increment" in property tax

revenues paid by the new hotel over the next forty or fifty years will

pay off the bonds issued. The people got nothing but the land

speculators have already received triple the market price. The value

of the location, enhanced by the freeway, was created by the people in

common, but it went into the wrong pockets.

In fact, all government activities which protect us, improve our

lives and put money into our pockets have a highly stimulating effect

on land prices. Also all activities of the people individually or in

common which are beneficial to the communities serve to increase land

values. SUPPOSE, for instance, that the Christian way of life became

the only way of life, and that crimes, immorality, smoking and

drinking, etc. were to cease. The BENEFICIAL EFFECTS on the community

would be enormous. SAVINGS would increase and the effective DEMAND for

land would increase, driving up the PRICES. The landowners would

become richer still, and the poor would become poorer still as a

result of this VERY DESIRABLE All-American Bliss.

Part

2

|