A Methodology for the Assessment

of the Gross National Land Value

of Mainland Britain

F. J. Jones

[Reprinted from Land & Liberty, Autumn

1975]

THE PRINCIPAL PROBLEM associated with the assessment of land values

in the UK is that official statistics dealing with the subject

normally use global property values which combine the value of land

with that of buildings. Thus a method has to be devised for separating

these two factors which must, if a proper economic analysis is to be

conducted, always be considered as distinct. Furthermore, there are

three broad categories of land to be taken into account: agricultural

land, housing land, and industrial and commercial land.

Agricultural land offers no special difficulties of assessment

because in this case alone Inland Revenue Statistics distinguish farm

land from farm buildings and produce two separate lists of values. On

the other hand, the problems associated with the areas of housing, and

with industrial and commercial land have in the past proved

progressively more difficult to deal with because these categories are

calculated exclusively in the form of composite land and building

assessments.

However, with housing land a hitherto unsuspected shortcut to an

approximate estimate of land value for the whole of mainland Britain

is now available, since new 'domestic' land sites are valued annually

on what amounts to a sample basis. Similarly, the annual average

density of housebuilding is provided, so that the average price per

plot can be calculated once we know the number of houses in existence.

Consequently, if we presuppose that the range of new buildings

provides the same variety of land values as the range of land for

older buildings, the regular updating of housing land values is simply

a matter of multiplying annual average plot prices by the total number

of houses.

If this seems over-simplistic, certain powerful checks are available.

The Land Registry Quarterly Report provides an average cost of houses

in England and Wales. We can therefore check the extra costs of labour

and materials each year which is also provided and make an allowance

for inflation. Then we have simply to deduct this regularly updated

average building cost per house from the cost of an average house on

the market, and land value per house per year is left as a residue.

It is also possible to carry out the same operation with mortgage

data. These figures are supplied by the Building Societies and

published in the Stationery Office's Housing and Construction reports.

They provide a range of average house prices in just the same way as

the Land Registry but, significantly, they are based on different

sources. Moreover, an annual index of price variations for development

land for housing also appears in the Housing & Construction data.

It extends from 1982 to 1992 in the most recent issue. So by applying

these indices to the base year's value we can obtain an incremental

increase or decrease in land prices year by year. In this way the

movement of land prices is dynamized and a picture of trends provided

over time.

The problems associated with industrial and commercial land are much

more complex. All that we have available in a comprehensive form are

the non-domestic rating figures, but these fortunately include a

global total for all the non-domestic rates levied annually in the UK.

The major problem is once again to separate land rents from building

returns.

Many types of supportive figures are also floated in commercial

publications, ranging from costs per square metre in commercial

centres for shops and offices to the prices of single or multiple

industrial sites; but these are neither comprehensive enough nor

sufficiently uncontaminated by capital returns on buildings to provide

anything like an overall picture.

HOWEVER, IT IS theoretically justifiable to apply, at least

temporarily, the housing land index to non-domestic rates, and this in

two ways: first in the manner in which it is applied to housing to

update land values annually from a fixed base; and second, in a global

sense to equate the proportion of land to buildings in the

non-domestic field with the known annual ratios for housing. In short,

the ratio of land value to building value in both cases should in a

free market be strictly proportional; and, granted the

disproportionate number of offices and warehouses to industrial

buildings even in the non-domestic area, the gap between the two

ratios should not be very wide. Hence our formula is that non-domestic

land values as a proportion of capitalized non-domestic rates are

broadly equal or proportionate to housing land values as a proportion

of global domestic property values.

I SHALL PUT forward here two slightly varying methodologies for

producing the necessary non-domestic statistics. The first is the one

adumbrated above, namely, that once we are in possession of an initial

total valuation either in rental or capitalized terms from the

non-domestic rate assessments, we could run the indexed slide-rule for

housing over these calculations and still produce reasonably

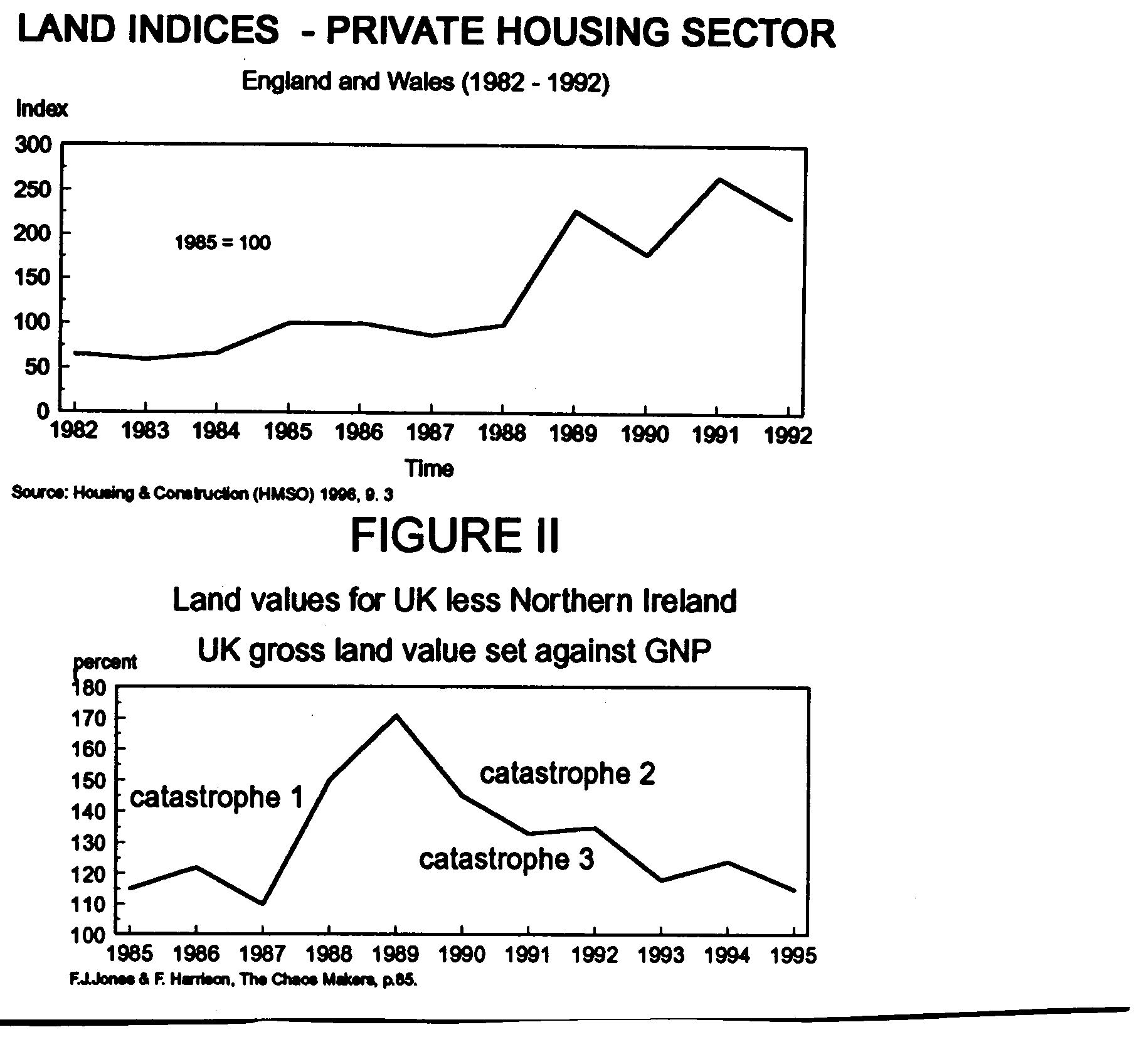

satisfactory results. The graph of the index of land values for

housing in England and Wales is given in figure 1.

Following our earlier explained methodology for housing land

assessments, such a guideline clearly offers us a way of revaluing all

housing land annually in retrospect. There is, however, one proviso:

it is that the cost of land on the open market is assumed to be the

same as all other land already utilised in the same way for housing

purposes in the past. This proviso seems to be a reasonable assumption

in free-market conditions for all land, whether domestic or

non-domestic in its zoning.

Let us now revert to our approach to the industrial and commercial

sectors set out earlier. The only sure figures that we have about the

sector is, we recall, the global value of non-domestic rates and their

capitalization as total land and building values. However, even using

official industrial and commercial statistics alone, we can go

somewhat further than this, because we have the range of categories

and numbers of non-domestic buildings in them which the global data

cover. We also have the total amount of rates obtained from each

category, such as shops, offices, warehouses, leisure centres etc. If

the highest rates are levied on the most valuable sites, a scale can

be devised for all other relative land values, with the highest

categories occupying the prime sites and so on down the scale. By

applying such a scale, the following tentative figures representing

proportions of land value to building value in the non-domestic field

emerge: shops 60%, offices 40%, factories 40%, warehouses 30%;

miscellaneous (other) 30%. From these figures a global but non-indexed

estimate can be deduced of non-domestic land values, though the

results cannot pretend to be as accurate as those of the housing

market. For this reason the first method will be adopted in all future

calculations, although our second graph to be presented later is based

on earlier results calculated by the second method.

Finally some additional areas of non-domestic rating for industry and

communications have also proved difficult. For North Sea oil and

gas-fields I have been forced to rely on the rather derisory figures

gained from government royalties and taxes. Likewise for roads I have

had to accept the equally derisory revenue from vehicle road licences.

In both these areas there is therefore a significant shortfall in

potential land value. The same can be said for some other minerals

besides oil; but, on the other hand, quarries, mines, railways and

other similar enterprises are included in non-domestic rates.

The results of this unavoidable indirect approach are perhaps at best

approximate, yet they nevertheless reveal the explosive nature of the

land-value graphs which derive from them. They show that capitalist

economies all have similar disruptive 'tigers in their tanks' due to

the speculative land values which lurk beneath the surfaces of their

economies. For the most part these disruptive forces which inevitably

trigger periodic booms and slumps -- are concealed from view in the UK

by being subsumed under the innocuous subhead of property values. The

almost steady-state facade which results is thus falsely reassuring,

and it so reduces the impact of the land cycle that for much of the

time it hardly seems to exist.

I have measured the worldwide effect of the land cycle on selected

capitalist economies in a recent book, The Chaos Makers

(Othila Press, 1997), written in collaboration with Fred Harrison. It

compares the annual ratios of land-value fluctuations with the

parallel fluctuations of the corresponding figures for GNP in all the

sampled economies. These ratios imply the existence of dramatic

fluctuations in investment in all cases, sometimes resulting in large

swings towards land speculation at the expense of industry and

commerce and at other times in similar swings towards productive

industry at the expense of land values.

Such swings act as a barometer for the prediction of booms and slumps

because they reveal crisis points emerging periodically as gross

imbalances in investment trends. Moreover, the swings towards higher

land prices are accompanied by rises in interest rates, because they

occur at a phase in the cycle in which profits from prolonged

speculative dealings in land become widespread. The reason for this is

that speculative land-fever leads to an increased demand for

speculative investment capital to fuel it, thereby depriving the

entrepreneur of reasonably-priced development capital. As a result,

capitalist economies periodically decline into deep recessions,

through a relative lack of productive demand. This demand is replaced

by a plethora of passive demand bidding up the value of real estate.

By means of catastrophe theory (a mathematical method of delineating

discontinuous processes) it can be demonstrated that these swings are

inevitable unless an annual land-tax is applied as a type of governor

to control the economic machine. Figure 2 compares the ratios of gross

land-values for mainland UK with GNP. In interpreting it, one should,

however, bear in mind that both booms and slumps are regarded as

catastrophes since they are equally disruptive.

The additional parameter of a tax on the full annual economic values

of land spread over the entire economy in these situations would

according to the prescriptions of catastrophe theory rapidly restore

the normal equilibrium between land and entrepreneurial investment and

pave the way for a progressive economic system to emerge. Such a tax

would thus have eliminated in the present instance the prolonged slump

of the early nineties. Furthermore, if the tax were permanently levied

as a principal feature of fiscal policy, it would ensure that the

economy would no longer be troubled by slumps. It would undergo only

the relatively minor dislocations occurring when major new techniques,

such as the computer revolution, appear on the market and replace

preceding technologies. However, after a short period of re-adjustment

these innovations tend to produce far more jobs than those that have

previously been lost.

|