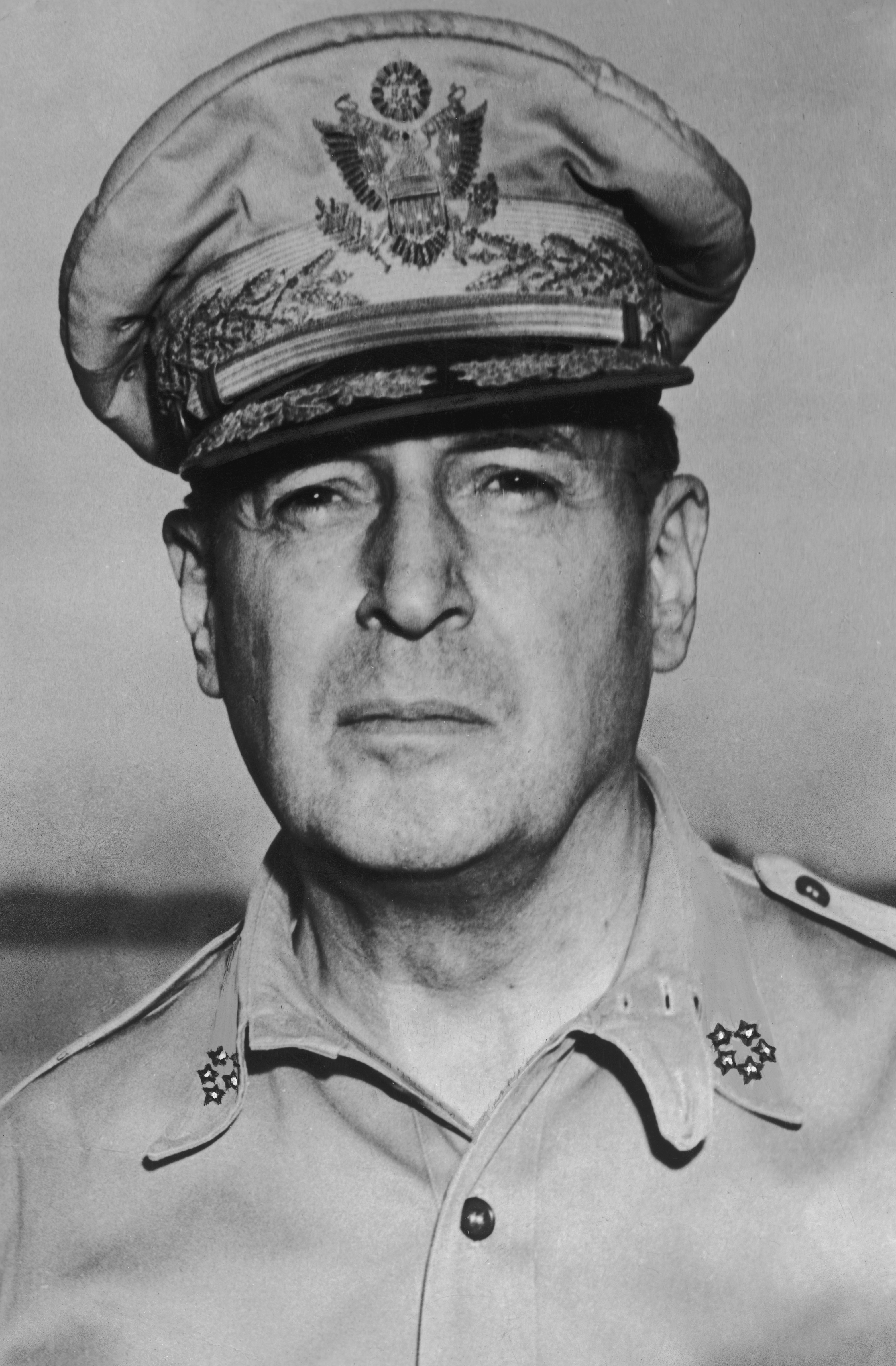

MacArthur,

Douglas

(1880-1964)

ENLARGE

|

Inspired by Henry George's reform proposals, MacArthur saw to it

that during his military governorship of Japan following the

Second World War that land rent reform was incorporated in the

writing of the Japanese Constitution. The new constitution

reversed the portion of agricultural commodities collected as rent

between owners (whose portion dropped to one-third of the total),

and the tenants farmers who actually did the work (who were then

able to retain two-thirds of what they produced).

James Michener, who served as MacArthur's economic adviser,

repeated this theme in his novel, Hawaii:

No nation can avoid land reform. All it can do is determine

the course it will take: bloody revolution or taxation.

|

MacDonell,

John |

An offer is made of a mode of raising revenue, which takes

from none what they have rightly earned, which need rob no one of

what he has rightly bought, and which will replenish the Treasury,

no man being mulcted, no man wronged; and are we to reject this

offer and for ever allow so many private interests to gather round

this public domain that it shall be useless and perverted? ...We

vex the poor with indirect taxes, we squeeze the rich, we ransack

heaven and earth to find new impost palatable or tolerable, and

all the time these hardships are going on; neglected or

misapplied, there have lain at our feet a multitude of resources

ample enough for all just common wants, growing as they form

Nature's budget. Such seems the rationale of the subject of which

the land question forms a part. And so we may say that, if

property in land be ever placed on a theoretically perfect basis,

no private individual will be the recipient of economic rent.

[From: The Land Question,]

|

MacDonald,

Ramsay |

"Our moral thoughts are usually cast ultimately into a

theological form, and so the land reformer's case is generally

opened by a statement like ' the land is God's common gift to

all.' Cast in its severely economic form, however, the point is

equally effective. Rent is a toll, not a payment for service. By

it social values are transferred from social pools into private

pockets, and it becomes the means of vast economic exploitation. .

. .Rent is obviously a common resource. Differences of fertility

and value of site must be equalised by rent, and it ought to go to

common funds and be spent in the common interest"

[Mr. J. Ramsay MacDonald, Socialism,

Critical and Constructive, p.164]

"Our old Socialist argument that economic rent must be

taken by the State, because it is created by circumstances of

which the whole community is entitled to take advantage, has been

enormously increased by the results and the experiences of the

war. And it is fundamental."

[Mr. J. Ramsay MacDonald, Socialism

after the War, p.53]

|

MacDonell,

John |

John Macdonell (1845-1921) served from 1901 to 1920 as professor

of law at University College, London. He was also a distinguished

jurist. The book, A Survey of Political Economy, based on

a series of articles published in the Scotsman newspaper.

My apology for essaying, in these circumstances, such a task

as is implied in the title "A Survey of Political Economy,"

rests on the possibility of this modest work turning attention to

others more exhaustive, on the absence of any book conceived on

the same plan, and on an intense desire ... to see political

economy divested of many fallacies, not the less false because

sometimes harsh and degrading.

[From: A Survey of Political

Economy (1871), Edinburgh: Edmonston and Douglas]

An offer is made of a mode of raising revenue, which takes

from none what they have rightly earned, which need rob no one of

what he has rightly bought, and which will replenish the Treasury,

no man being mulcted, no man wronged; and are we to reject this

offer and for ever allow so many private interests to gather round

this public domain that it shall be useless and perverted? ...We

vex the poor with indirect taxes, we squeeze the rich, we ransack

heaven and earth to find new impost palatable or tolerable, and

all the time these hardships are going on; neglected or

misapplied, there have lain at our feet a multitude of resources

ample enough for all just common wants, growing as they form

Nature's budget. Such seems the rationale of the subject of which

the land question forms a part. And so we may say that, if

property in land be ever placed on a theoretically perfect basis,

no private individual will be the recipient of economic rent.

[From: The Land Question,

(1873)]

|

Mann,

Thomas

ENLARGE

|

In 1886 I read Henry George's book, Progress and Poverty. This

was a big event for me; it impressed me as by far the most

valuable book I had so far read. It enabled me to see more clearly

the vastness of the social problem, to realize that every country

was confronted by it.

Henry George's cure for economic problems, as advocated in

Progress and Poverty is the Singl Tax. I could not accept all

George's claims on behalf of his proposal, though for lack of

economic knowledge I was unable to refute these claims.

His book was a fine stimulus to me, full of incentive to noble

endeavour, imparting much valuable information, throwing light on

many questions of real importance, and giving me what I wanted --

a glorious hope for the future of humanity, a firm conviction that

the social problem could and would be solved. I must again give a

reminder that Socialism was known only to a few persons, and that

no Socialist organization existed at that time.

[From: Memoirs, 1923]

|

Manning,

Henry E.

(Cardinal)

ENLARGE

|

There is a natural and divine law anterior and superior to all

human and civil law, by which every people has a right to live of

the fruits of the soil on which they are born and in which they

are buried.

[From a Letter to Earl Grey (1868),

Miscellanies, Vol.I, p.239]

|

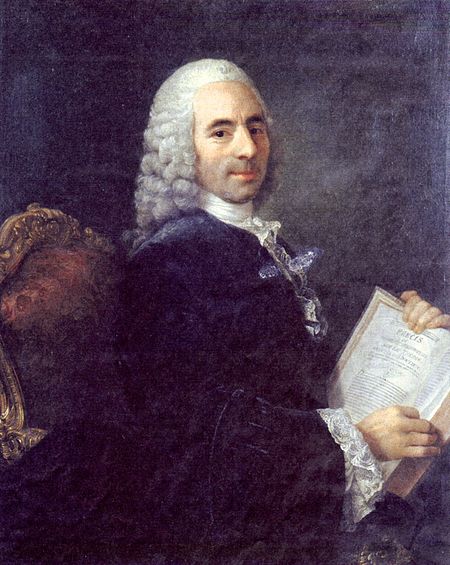

Marmontel,

Jean-Francois

ENLARGE

|

The land is a solemn gift which nature has made to man; to be

born then is for each of us a title of possession. The child has

no better birthright to the breast of its mother.

[From: Address in Favor of the

Peasants of the North (1757), Euvres, Vol. X, p.56.]

|

Marmontel,

Jean-Francois |

Hence those immense landed estates which luxury condemns to

barrenness and which for the gratification of one man deprive a

population of existence who would otherwise be born to cultivate

it.

[From: Address in Favor of the

Peasants of the North (1757), Oeuvres, Vol. X, p. 68]

|

Marti,

Jose |

Jose Marti, the hero of Cuban independence, described Henry

George as:

...one of the most cogent and audacious thinkers, ...George's

book was a revelation not only for the workers, but also for the

intellectuals. Only Darwin, in the natural sciences, left an

impression comparable to that of George in the social sciences.

...His devotion can be compared to the love of Nazareen, expressed

in the language of our times. ...

|

Martineau,

Harriet

ENLARGE

|

Harriet Martineau, the daughter of a textile manufacturer from

Norwich, was born in 1802. Following her education, she began

writing articles in the 1820s for the Monthly Repository

and in 1829 moved to London and joined the staff of this journal.

She broadened her writing to include books on politics and

economics directed to the general public. Among her influences

were Jeremy Bentham and John Stuart Mill. Her 1832 book, Illustrations

of Political Economy sold well, which was followed by Poor

Laws and Paupers Illustrated (1834).

Martineau then visited the United States for two years, recorded

her observations in the book, Society in America (1837),

which commented on the many contradictions between stated

democratic principles and the reality of life for many Americans,

particularly women.

She suffered from poor health throughout much of her life and

died of bronchitis in 1876.

The old practice of man holding man as property is nearly

exploded among civilized nations; and the analogous barbarism of

man holding the surface of the globe as property cannot long

survive. The idea of this being a barbarism is now fairly formed,

admitted and established among some of the best minds of the time;

and the result is, as in all such cases, ultimately secure.

[From: Autobiography (1855),

Vol.II, Sec. 10, p. 119]

|

Martineau,

Harriet

|

Before any effectual social renovation can take place, men

must efface the abuse which has grown up out of the transition

from the feudal to the more modern state; the abuse of land being

held as absolute property.

[From: Autobiography (1855),

Vol.II, Sec. 10, p. 119]

|

Marx,

Karl

ENLARGE

|

Monopoly of land is the basis of monopoly in capital.

|

Marx,

Karl |

We have seen that the expropriation of the mass of the people

from the soil forms the basis of the capitalist mode of

production. The essence of a free policy, on the contrary,

consists in this: That the bulk of the soil is still public

property, and every settler on it, therefore, can turn part of it

into his private property and individual means of production

without hindering the later settlers in the same production.

[From: Capital, Chap. XXXIII,

English Translation, pp. 793-4]

|

McArdle,

Peter J. |

Peter J. McArdle (1874-1940) was first elected to Pittsburgh City

Council in 1911; he served for over 27 years. He was a member of

the City Planning Commission. Previous to public office he had

worked in a rolling mill and was active in union councils within

the steel industry.

The graded tax law has, in my opinion, been of decided benefit

to the City, and to home owners in particular, by furnishing an

added impetus to the development of vacant land located within the

city limits.

[Source of the above quote is not

known. Reprinted from literature published by the Henry George

Foundation of America]

|

McConnell,

Campbell

ENLARGE

|

In the cities the present arrangement of relatively high

property taxes on buildings and relatively low taxes on land tends

to have perverse effects upon incentives. The relatively light

taxes on land mean that landowners find the tax costs involved in

holding vacant land ot be comparatively small, and so they are

encouraged to withhold land form productive uses in order to

speculate on increases in its value. Such action -- or inaction --

prevents growth of the property-tax base and contributes to the

fiscal problems of the cities.

[Quote from the textbook, Economics,

1978 edition, p.754]

|

McGinnis,

Bernard B. |

As a young man active in Democratic politics and civic

movements, I joined in a popular movement in 1913 which resulted

in the Legislature adopting a Graded Tax for cities of the second

class. It was a very simple measure endorsed by leading civic

organizations and newspapers and sponsored politically by William

A. Magee, then the Republican Mayor of Pittsburgh.

Since 1925 the cities of Pittsburgh and Scranton have taxed all

dwellings and other buildings at just one-half of the rate levied

on the land; the purpose being to encourage private improvements

to real estate and to discourage the holding of valuable land for

speculation.

This Graded Tax plan is generally accepted in Pittsburgh and has

meant lower taxes for the great majority of home owners as well as

for others whose properties are well improved. It has been

strongly supported through the years by our Mayors and Councilmen,

both Republican and Democratic. It is also helping Scranton to

attract new industries and to lower taxes on homes.

[Pennsylvania State Senator, 1959]

|

McGlynn,

Edward (Father)

ENLARGE

|

He was simply a seer, a prophet, a forerunner sent by God, and

we can say in all reverence and in the words of the Scriptures

when they said that "There was a man sent from God, whose

name was John he was sent to bear witness to the light." I

believe I am not guilty of any profanation of the sacred

Scriptures when I say there was a man sent from God, and his name

was Henry George.

[source not known]

|

Michener,

James

ENLARGE

|

No nation can avoid land reform. All it can do is to determine

the course it will take: bloody revolution or taxation.

|

Mill,

James

ENLARGE

|

James Mill discussed land taxation much more fully than did Adam

Smith or Ricardo. In his Political Economy, 1821, he suggested [p.

243] that in a new country the rent of land would be a source

peculiarly adapted to defray the expenditures of the state without

burdening anyone. But in old countries:

... where land has ... been converted into private property,

without making rent in a peculiar manner answerable for the public

expenses; where it has been bought and sold upon such terms, and

the expectations of individuals have been adjusted to that order

of things, rent of land could not be taken to supply exclusively

the wants of the government without injustice.

James Mill's Political Economy is noteworthy in that it contains

the earliest thorough consideration of the merits of a tax upon

the "unearned increment" of land values. Much of the

credit should be given to James Mill rather than, as is usual, to

his more distinguished son. James Mill wrote in Political Economy

[p.247]:

This continual increase, arising from the circumstances of the

community, and from nothing in which the land-holders themselves

have any peculiar share, does seem a fund no less peculiarly

fitted for appropriation to the purposes of the state, than the

whole of the rent in a country where land had never been

appropriated.

|

Mill,

John Stuart

ENLARGE

|

John Stuart Mill, in his Political Economy, 1848, took

the position that land ownership is less justifiable than the

ownership of other wealth. "Landed property," he said, "is

felt, even by those most tenacious of its rights, to be a

different thing from other property."

When the sacredness of property is talked of, it should always

be remembered that any such sacredness doe snot belong in the same

degree to landed property. No man made the land. It is the

original inheritance of the whole species. Its appropriation is

wholly a question of general expediency. When private property in

land is not expedient, it is unjust. It is no hardship to anyone

to be excluded from what others have produced: they were not bound

to produce it for his use, and he loses nothing by not sharing in

what otherwise would not have existed at all. But it is some

hardship to be born into the world and to find all nature's gifts

previously engrossed, and no place left for the new-comer. [book

2, ch. 2, sec. 26.]

The ordinary progress of a society which increases in wealth, is at all

times tending to augment the incomes of landlords; to give them both a

greater amount and a greater proportion of the wealth of the community,

independently of any trouble or outlay incurred by themselves. They grow

richer, as it were in their sleep, without working, risking, or

economizing. What claim have they, on the general principle of social

justice, to this accession of riches? [Book 5 Chapter 2 Section 28]

|

Mill,

John Stuart |

Those who think that the land of a country exists for the sake

of a few thousand land-owners, and that so long as rents are paid,

society and government have fulfilled their function, may see in

this consummation a happy end to Irish difficulties. But this is

not a time, nor is the human mind now in a condition, in which

such insolent pretensions can be maintained. The land of Ireland,

the land of every country, belongs to the people of that country.

[From: Political Economy,

Book II., Chap. 10, Sec. 1]

|

Mill,

John Stuart |

A tax on rent falls wholly on the landlord. There are no means

by which he can shift the burden upon anyone else.

[From: Elements of Political

Economy, Book V, Chap. III, Sec. 2]

|

Mill,

John Stuart |

The essential principle of property being to assure to all

persons what they have produced by their labor and accumulated by

their abstinence, this principle cannot apply to what is not the

product of labor, the raw material of the earth.

[From: Political Economy,

Book II, Chap. 2, Sec. 5]

|

Mill,

John Stuart |

When the "sacredness of property" is talked of, it

should always be remembered that any such sacredness does not

belong in the same degre to landed property.

[From: Political Economy,

Book II, Chap. 2, Sec. 6]

|

Mill,

John Stuart |

The greatest "burthen on land is the landlords."

[From: Elements of Political

Economy, Book II, Chap. 2, Sec. 6]

|

Mill,

John Stuart |

The social problem of the future we consider to be how to

unite the greatest individual liberty of action with a common

ownership in the raw material of the globe, and an equal

participation of all in the benefits of combined labor.

[From: Autobiography, Chap.

VII, p.232]

|

Mill,

John Stuart

|

The ordinary progress of a society which increases in wealth

is at all times to augment the incomes of landlords -- to give

them both a greater amount and a greater proportion of the wealth

of the community, independently of any trouble or outlay incurred

by themselves. They grow richer as it were in their sleep, without

working, risking or economizing. What claims have they, on the

general principlesof social justice, to this accession of riches?

[From: Principles of Political

Economy, Book V, Chap. 2, Sec. 5]

|

Miller,

Karen |

Secretary of the Pennsylvania Department of Community Affairs,

responded to a question from Walter Rybeck about whether her

Housing Task Force had looked at the two-rate property tax, as

follows:

No, because the eleven cities using that form of property tax

don't have an affordable housing problem.

|

Mitchell,

Margaret

ENLARGE

|

Land is the only thing in the world that amounts to anything,

for 'Tis the only thing in this world that lasts, 'Tis the only

thing worth working for, worth fighting for -- worth dying for.

|

Modigliani,

Franco

ENLARGE

|

It is important that rent of land be retained as a source of

government revenue. Some persons who could make excellent use of

land would be unable to raise money for the purchase price.

Collecting rent annually provides access to land for persons with

limited access to credit.

[Franco (1918-1985) was the 1985 winner

of the Nobel Prize for economics]

|

Moley,

Raymond

ENLARGE

|

Private investment for urban rebuilding can be attracted by

modifying our tax system to encourage new construction and better

land use. High land taxes and lower levies on improvements will

compel owners to build or sell to those who will build. To a

greater extent this emphasis on a change to land taxation is being

accepted by planners, architects, public authorities and

economists.

The point is not a new one. Those who improve their property are

now penalized by higher taxes. Those who maintan slums are

rewarded by a rise in land values.

[From: Newsweek, August 21,

1967]

|

Mondale,

Walter

ENLARGE

|

As you know, land is subject to local rather than federal

jurisdiction, but it would be interesting to see the results of

local experiments along the lines you suggest. One of the great

advantages of our federal system is that it permits such

experiments to take place.

There are, however, a number of things which the federal

government could do to further the taxation of land values. It

could levy such a federal tax itself and this would be much

preferable to taxes on labor and capital investment. It could

establish a new city based solely on land value taxation in order

to demonstrate the feasibility of that principle. It could remove

the income tax deduction for the property tax insofar as it falls

on buildings, thereby encouraging localities to raise more of

their property tax on land instead. And finally, it could so

adjust the revenue sharing formula that the more a city relies on

the taxation of land values for its local revenue, the larger its

federal revenue share would be.

[From a letter dated May 19, 1983 to

the editor of Incentive Taxation]

|

Moore,

Stephen

ENLARGE

|

I have long been an admirer of the Henry George philosophy, as

I think most of us here at the Cato Institute are.

[199-]

|

More,

Thomas

ENLARGE

|

When an insatiable wretch, who is a plague to the whole

country, resolves to enclose many thousand acres of ground the

owners as well as the tenants are turned out of their possessions

by trick or by main force, or being wearied out with ill usage

they are forced to sell them.

[From: Utopia (1516), Book I]

|

More,

Thomas |

"The increase of pasture", said I, "by which

you sheep, which are naturally mild, and easily kept in order, may

be said now to devour men, and unpeople, not only villages, but

towns; for wherever it is found that the sheep of any soil yield a

softer and richer wool than ordinary, there the nobility and

gentry, and even those holy men the abbots, not contented with the

old rents which their farms yielded, nor thinking it enough that

they, living at their ease, do not good to the public, resolve to

doit hurt instead of good. They stop the course of agriculture,

destroying houses and towns, reserving only the churches, and

enclose grounds that they may lodge their sheep in them.

As if forests and parks had swallowed up to little of the land,

those worthy countrymen turn the best inhabited places in

solitudes, for when an insatiable wretch, who is a plague to his

country, resolves to enclose many thousand acres of ground, the

owners as well as tenants are turned out of their possessions, by

tricks, or by main force, or being wearied out with ill-usage,

they are forced to sell them. By which means those miserable

people, both men and women, married and unmarried, old and young,

with their poor but numerous families (since country busines

requires many hands), are all forced to change their seats, not

knowing whither they go; and they must sell almost for nothing

their household stuff, which could not bring them much money, even

though they might stay for a buyer.

When that little money is at an end, for it will be soon spent,

what is left for them to do, but either to steal and so to be

hanged (God knows how justly), or to go about and beg? And if they

do this, they are put in prison as idle vagabonds; while they

would willingly work, but can find none that will hire them; for

there is no more occasion for country labor, to which they have

been bred, when there is no arable ground left. One shepherd can

look after a flock which will stock an extent of ground that would

require many hands if it were to be ploughed and reaped. This

likewise in many places raises the price of corn.

[From: Utopia (1516), Book 1]

|

More,

Thomas

|

There is a great number of noblemen among you, that are

themselves as idle as drones, tht subsist on other men's labor, on

the labor of their tenants, whom, to raise their revenues, they

pare to the quick.

[From: Utopia (1516), Book I]

|

More,

Thomas

|

For they account it a very just cause of wr for a nation to

hinder others from possessing a part of the soil, of which they

make no use, but which is suffered to lie idle and cultivated;

since every man has by the law of Nature a right to such waste

portion of the earth as is necessary for his subsistence.

[From: Utopia (1516), Book II,

tit. Of Their Traffic]

|

Morley,

John

ENLARGE

|

It will be thought an intolerable thing that men shall derive

enormous increments of income from the growth of towns to which

they have contributed nothing -- that they shall be able to sweep

into their coffers what they have not produced -- that they shall

be able to go on throttling towns, as they are well known to do in

some cases. It is impossible to suppose that the system will not

be vigorously, powerfully, persistently and successfully attacked.

[From a speech at Forfar, 4 October,

1897. Reprinted in The Times, 5 October, 1897, p.5, column

3]

|

Morris,

William

(1834-1896)

ENLARGE

|

Toward the end of the 1870s, Morris became increasingly involved

in political activism, and by 1883 he had joined H. M. Hyndman's

Socialist League. Rejecting Hyndman's grand plan to unify all

socialist groups in England, Morris helped form the new Socialist

League and became the editor of its journal. When the Socialist

League waxed more extreme and the prospects for real revolution

grew dim, Morris left the organization and founded the Hammersmith

Socialist Society, which met at Kelmscott House and served as a

forum for Sunday evening lectures and discussion on political and

social issues.

Not seldom a piece of barren ground or swamp, worth nothing in

itself, becomes a source of huge fortune to him from the

development of a town or a district, and he pockets the results of

the labor of thousands upon thousands of men, and calls it his

property.

[From: Signs of Change

(1888), p.188]

|

Morris,

William

|

Society will be changed from its basis when we make the form

of robbery called profit impossible by giving labor full and free

access to the means of fructification -- i.e., to raw material.

[From: Signs of Change

(1888), p.201]

|

Moses |

It is written in Leviticus X MV:XXIII that Jehovah said to Moses:

The land shall not be sold forever; for the land is mine.

|

Murphey, Dwight D.

ENLARGE

|

Do Market Economies Allocate Resources Optimally? A response by

Dweight D. Murphey, Prof. of Business Law, Wichita State

University, to Walter Block:

Nor are such societies sufficiently sensitive to the moral

issues. An inequality borne out of differences in ability, effort,

character, market discernment, and the like, is a morally

justifiable inequality. But, as henry George pointed out a century

ago, some wealth accrues to individuals without any relationship

either to merit or to a productive meeting of consumers' needs.

George made this point with regard to the increase in land values

that comes from increasing population near the land. During the

past century, most classical liberals, including myself until

recently, have not become followers of George (who was in all

other ways a devout free-market thinker) because it has seemed

better to let the market work without qualification than to make

an admission that socialists could use to their own advantage.

Now, however, with the rapid advance of computerization, robotics,

materials sciences, and biotechnology, Henry George's observation

becomes even more pertinent. Those in the year 2030, for example,

who make a fortune as computer experts will make only a part of

that income from their own effort; instead, they will have

inherited from the civilization in which they live the work of

countless geniuses who will have preceded them, and much of their

income will be due to those previous successes. How appropriate

will it be then to say that "any amount of inequality is all

right, because it arises out of the successful peoples' success in

the market"? Will future classical liberals be able to say

that with a clear conscience if billions of people are faring

quite badly?

[From: Markets & Morality,

Vol. 2, No. 2, Fall 1999]

|

Murphy,

Dennis |

If you improve your home by remodeling or building an

addition, your taxes will rise, because we tax the improvements.

If you own a rental property, and make improvements for your

tenants, the taxes will increase, regardless of location. Tax only

the land and tax it at a rate appropriate to its highest and best

use.

The results would be dramatic.

Would the old Flame Tavern sit empty year after year? Or would

ordinary economic incentives push the owners -- whom, by the way,

I do not know -- to either make better use of the opportunities

presented by these sites or sell to willing buyers who would?

[Dean of the College of Business & Economics, Western

Washington University. Quote from the Bellingham Washington

Herald, June 2, 1966]

|

Murray,

J.F.N. |

Murray is a prominent assessor and author of Principles and

Practice of Valuation, (Sidney. Commonwealth Institute of

Valuers, Fourth Edition, 1969, a leading textbook on appraising in

Australia.

Valuation is the most important subject in the social

sciences, but it has always been outside the scope of economics as

taught in the universities. ...It is maintained that a

re-integration of the theory of valuation with the main body of

economic theory would lead to an advancement of learning and to a

soundly-based national economy.

[source not identified, only in 1967,

from an academic publication]

|

Muskie,

Edmund

ENLARGE

|

We must ask whether it is fair that our federal tax laws --

which mermit homeowners to deduct property tax payments from their

income tax -- provide no real relief for apartment dwellers whose

rent is increased by their landlords as a result of these same

property taxes.

Still a more basic question is whether any property taxes should

be levied against buildings and improvements (or) whether they

should be levied completely or primarily on land value itself.

[There is a good argument that it is] socially undesirable [to tax

the land speculator less than the owner who improves his proerty,

that urban decay can be blamed on property taxes which penalize

properties, and that property taxes encourage land speculation

rather than logical land development].

[Source: Hugh I. Morris. "Muskie

Weighs Probe Of Property Taxes," The Evening Bulletin,

8 January 1971.]

|

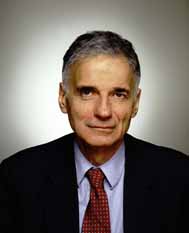

Nader,

Ralph

ENLARGE

|

Nader's group Public Citizen wrote a booklet recommending:

We reduce taxes on people and increase taxes on nonrenewables.

A 1994 commentary on urban sprawl contained this observation

about the property tax:

Site-value property taxation may also spark greater

development in cities by taxing land, not buildings. Unlike

traditional taxation -- which rewards developers who put up cheap,

tacky housing and strip malls -- site-value taxation gives

developers the incentive to build gracious, durable buildings.

Allowances for affordable housing, however, need to be part of

site-value schemes.

|

Nader, Ralph |

We need a big debate on different kinds of taxation, to talk

about how corporations are freeloading on public services and

getting tax breaks while taxes are falling on workers and smaller

businesses. We need to open a debate about land taxation and Henry

George, to tax bad things, not good things, and not to tax people

who go to work every day.

|

Nechyba,

Thomas J.

ENLARGE

|

The idea tht land value taxation is unrealistic or would drive

land prices into negative numbers is based on a static view of the

economy, where no one responds to tax changes by substituting one

factor for another. Once you accept that behavior will change in

response to taxes, that static view no longer applies. Under these

fairly conservative assumptions, tax reforms that use land taxes

to eliminate entire classes of distortionary taxes are

economically feasible in virtually all states.

[From a "Faculty Profile"

interview published in Land Lines, the newsletter of the

Lincoln Institute of Land Policy, January 2002. Mr. Nechyba is

professor of economics at Duke University, Durham, N.C.]

|

Necker,

Jacques

ENLARGE

|

Nearly all civil institutions were made for the benefit of the

rich. If we peruse our books of law, we are startled at finding

everywhere the confirmation of teh fact. It could almost be said

that a few people, after dividing the earth among themselves,

ordained laws to fortify themselves against the multitude.

[From: Essay on the Corn-Laws

(1775), Part III, Chap. 12, Oeuvres, Vol. I, p. 333]

|

Necker,

Jacques

|

The right of inheriting property is a law of men; it was

established for their welfare and can only be continued on that

condition. He who, at the beginning of society, staked out a piece

of ground, and threw there some seed which nature had

spontaneously produced elsewhere, could never have obtained on

this title alone the exclusive right of holding the ground for his

descendants forever.

[From: Essay on the Corn Laws

(1775), Oeuvres Completes, Vol.I, p.142]

|

New Republic editors |

As Henry George explained more than a century ago in Progress

and Poverty, the cost of natural resources is nothing more than a

tax on the productive elements of the economy -- labor and

capital.

|

Newcomb,

Simon

(1835-1909)

ENLARGE

|

The doctrine that the soil is of natural right the

common property of the human race, and that each individual should

be allowed to enjoy his share, is now tacitly admitted by many

eminent economists in England and France.

[From: "The Labor Question,"

North American Review, July, 1879, p.151]

|

Newman,

Francis William

|

Newman was born in Born in London, and graduated from Oxford in

1826. He was elected fellow of Balliol College Oxford in the same

year but resigned in 1830, leaving for Baghdad to serve as

assistant in the mission of the Rev. A. N. Groves. In 1833 he

returned to England and eventually accepted the position of

classical tutor in an unsectarian college at Bristol. In 1840 he

became Professor of Latin in Manchester New College, a Unitarian

seminary at York. In 1846 he quit this appointment to become

professor in University College, London, where he remained until

1869. In 1850, he produced ttwo works, Phases of Faith and

Passages from the History of my Creed, the former an analysis of

the relations of the spirit of man with the Creator; the latter a

religious autobiography detailing the author's passage from

Calvinism to pure theism.

He also wrote on logic, political economy, English reforms,

Austrian politics, Roman history, and many other subjects. His

miscellaneous essays were collected in several volumes before his

death. He died in 1897.

Here is the fundamental error, the crude and monstrous

assumption, that the land which God has given to our nation, is or

can be the private property of anyone. It is a usurpation exactly

similar to that of slavery.

[From: Lectures on Political

Economy (1851), Lecture VI., p. 133]

|

Netzer,

Dick

ENLARGE

|

My ideal system of local finance would comprise user charges

and land value taxation.

[Dean, Graduate School of Political

Science, New York University; quote from Property Tax Reform,

Urban Institute, 1973, edited by George Peterson]

|

Netzer,

Dick |

User fees and land-value taxation are considered by most

experts as the best way to finance city government.

[Dean, New York University; from

remarks at a 1982 meeting of the Federal Reserve Bank in

Philadelphia]

|

NEW YORK TIMES |

Too bad that Henry George, the author of Progress and Poverty,

is not around to advise New York State's Comptroller, Edward

Regan, on the economics of land and housing. Analyzing New York

City's J-51 program to stimulate the rehabilitation of old

buildings with tax concessions. Mr. Regan says it costs a fortune,

or at least too much. Henry George would have told Mr. Regan that

he has it exactly wrong. It's the tax on building improvements,

not the tax abatement, that leads to poverty.

[editorial, August 5, 1980]

|

Norquist,

John

ENLARGE

|

Question and Answer with Mayor John Norquist of Milwaukee,

Wisconsin. Tuesday, January 26, 1999, at The Landmark Series:

Q: Have you looked at alternative property tax systems such as

a two-tier land value based system to encourage efficient use?

A: Great idea and almost impossible to get politically.

Usually the constitutions in most states block it but it's been

great for Pittsburgh. You almost can't find an empty lot in

downtown Pittsburgh.They've done a lot of things wrong in

Pittsburgh but one thing they did right was having this land value

taxation so there's no incentive to have an empty lot. Having a

parking lot doesn't make sense economically so the buildings fill

in and you don't have these big empty spots. So if you can do it

in Minnesota, go for it. It's good for the city.

|

Norris,

Kathleen |

Any one who really fears a revolution in America ought to

reread Henry George's "Progress and Poverty," one of the

great social documents of all time. I first read it thirty years

ago. ...Today the book is good as ever, and the theory as sane.

... In all the years -- with the travel, study, opportunity for

observation of social conditions -- in all these yers I have never

known his premises to be shaken in the least.

|

Nowak,

Jeremy

ENLARGE

|

"Cities should abolish all business taxes that inhibit

the location of startup firms or discourage investment in

productivity-enhancing equipment or practices, including all forms

of gross receipts or turnover and net profits taxes. Cities should

also replace the business property tax with a tax on the market

value of land, coupling the land tax with the broader use of

business improvement districts or tax increment finance districts

to pay for major infrastructure investments. Land taxes, which may

initially be extraordinarily low, even zero, in some especially

distressed neighborhoods, have several advantages over property

taxes in keeping a city's economy competitive. They discourage

speculative land banking. They encourage businesses to place as

much capital on property as is economically justifiable because

non-land forms of real property are not taxed. They strongly

encourage city government practices that preserve the value of

land. And, finally, they are a powerful incentive to maintain

properties.

"Local personal taxes commonly take three forms: sales

taxes, wage or income taxes, and property taxes, the latter being

the most common. A residential property tax has two components-a

land tax and a tax on the value of the structure. The land

component of the residential property tax should be assessed on an

equal basis with the business land tax, again providing incentives

to develop in neighborhoods with low land values, as well as

preventing speculative land banking."

[From: "Only Radical Strategies

Can Help America's Most Distressed Cities," by Edward W. Hill

and Jeremy Nowak. Brookings Review, Summer 2000, Vol.18,

No.3, Pages 22-26]

|

Oates,

Wallace

ENLARGE

|

What the Pittsburgh experience suggests to us is that the

movement to a graded tax system can, in the right setting, provide

some stimulus to local building activity. The primary role of the

land tax in all this is to provide the additional source of

revenues that allows a reduction in the rate on improvements.

[Professor of Economics, University

of Maryland; from a research report written with Robert Schwab]

|

Ogilvie,

William |

William Ogilvie, Professor of Humanities in King's College,

Aberdeen, was an eighteenth century thinker who anticipated

certain of Henry George's ideas. In 1782 he published anonomously

An Essay on the Right of Property in Land with respect to its

Foundation in the Law of Nature. He believed that the equal

right of all men to the earth was "a birthright which every

citizen still retains", and as a means for securing that

right he proposed a "progressive agrarian law", under

which men were to be permitted to claim their birthright share

from unoccupied lands, and those holding more than this share were

gradually to be deprived of their surplus of land, retaining,

however, the title to any improvements which they might have made.

Ogilvie's ideas on taxation were somewhat vague, but he wrote in

a footnote that he believed a land tax to be the most equitable

form of tax. The landowner, he believed, enjoyed a revenue without

performing a corresponding social service. He suggested a tax on

barren lands to force the owner either to cultivate or dispose of

them. Ogilvie was probably the first to suggest definitely a tax

on the increment of land values. He wrote:

A tax on all augmentation of rents, even to the extent of one

half of the increase, would be at once the most equitable, the

most productive, the most easily collected, and the least liable

to evasion of all possible taxes, and might with inconceivable

advantage disencumber a great nation from all those injudicious

imposts by which its commercial exchanges are retarded and

restrained, and its domestic manufactures embarrassed.[p.9]

Ogilivie also wrote about access to land as a natural right:

When a child is born, we recognise that it has a natural right

to its mother's milk, and no one can deny that it has the same

right to mother-earth. It is really its mother-earth, plus the dew

and sunshine from heaven and a little labour, that supplies the

milk and everything else required for its subsistence. The monster

that would deprive the babe of its mother's milk, or would

monopolise the breasts of several mothers, to the exclusion of

several children, is not more deserving of being destroyed than

the monster who seizes absolute possession of more than his share

of the common mother of mankind, to the exclusion of his

fellow-creatures.

[From the Preface to William

Ogilvie's "Birthright in Land" (1782), Augustus M Kelley

edition (1970), p.xix]

|

Ogilvie,

William |

Ogilvie begins his "Essay on the Right of Property in Land"

with the following:

1. "All right of property is founded either in occupancy

or labor. The earth having been given to mankind in common

occupancy, each individual seems to have by nature a right to

possess and cultivate an equal share. This right is little

different from that which he has to the freeuse of the open air

and running water; thought not so indispensably requisite at short

intervals for his actual existence, it is not less essential to

the welfare and right state of his life through all of its

progressive stages.

2. "No individual can derive from this general of occupancy

a title to any more than any equal share of the soil of his

country. His actual possession of more cannot of right preclude

the claim of any other person who is not already possessed of such

equal share.

3. "This title to an equal shre of property in land seems

original, inherent, and indefeasible by any act or determination

of others, though capable of being alienated by our own. It is a

birthright which every citizen still retains. Though by entering

into society and partaking of its advantages, he must be supposed

to have submitted this natural right to such regulations as may be

established for the general good, yet he can never be understood

to have tacitly renounced it altogether; --

4. "Every state or community ought in justice to reserve for

all its citizens the opportunities of entering upon or returning

to land resuming this their birthright and natural employment,

whenever they are inclined to do so.

"Whatever inconveniences may -- accompany this reservation,

they ought not to stand in the way of essential justice.

5. "In many rude communities, this original right has been

respected, and their pubilc institutions accommodated to it, by

annual, or at least frequent partitions of the soil, as among the

ancient Germans, and among the native Irish even in Spencer's

time.

"Wherever conquests have taken place, this right has been

commonly subverted and effaced.

"In the progress of commercial arts and refinements, it is

suffered to fall into obscurity and neglect.

7. "That right which the landholder has to an estate,

consisting of a thousand times his own original equal share of the

soil, cannot be founded in the general right of occupancy, but in

the labor which he and those to whom he has succeeded, or from

whom he has purchased, have bestowed on the improvement and

fertilization of the soil. To this extent, it is natural and just;

but such a right founded in labor cannot supersede that natural

right of occupancy, which nine hundred and ninety-nine other

persons have to their equal shares of the soil, in its original

state ..."

9. "On the first of these maxims depend the freedom and

prosperity of the lower ranks. On the second, the perfection of

the art of agriculture."

|

Ogilvie,

William |

The earth having been given to mankind in common occupancy,

each individual seems to have by nature a right to possess and

cultivate an equal share.

[From: Essay on the Right of

Property in Land (1781), Part I, Section I]

|

Ogilvie,

William |

Internal convulsions have arisen in many countries by which

the decisive power of the State has been thrown, for a short while

at least, into the hands of the collective power of the people. In

these junctures they might have obtained a just re-establishment

of their natural rights to independence of cultivation and to

property in land, had they been themselves aware of their title to

such rights, and had there been any leaders prepared ot direct

them in the mode of stating their just claim, and supporting it

with necessary firmness and becoming moderation.

[From: Essay on the Right of

Property in Land (1781), Part II, Section 3, Paragraph 57]

|

O'Rell,

Max

ENLARGE

|

I hold that the earth was meant for the human race and not for

a few privileged ones.

[From: North American Review,

January, 1899, p.36]

|

Paine,

Thomas

(1737-1809)

ENLARGE

|

In the age of rebellion against monarchy and landed aristocracy,

Paine brought his ideas from the Old World to North America. He

wrote the pamphlet Common Sense which helped to ignite the

spirit of rebellion in the colonial citizens of England's

colonies. In a later pamphlet, Agrarian Justice, he wrote:

[I]t is the value of the improvement, only, and not the earth

itself, that is individual property. Every proprietor, therefore,

of cultivated lands, owes the community a ground-rent (for I know

of no better term to express the idea) for the land which he

holds; and it is from this ground-rent that the fund proposed in

this plan is to issue. ...The plan I have to propose ... is, To

create a national fund, out of which there shall be paid to every

person, when arrived at the age of twenty-one yers ... a

compensation in part, for the loss of his or her natural

inheritance, by the introduction of landed property ...

Men did not make the earth, and though he had a natural right to

occupy it, he had no right to locate as his property in perpetuity

any part of it; neither did the Creator of the earth open a

land-office, from whence the first title-deeds should issue.

"The earth, in its natural state … is supporting but

a small number of inhabitants, compared with shat it is capable of

doing in a cultivated state. And impossible to separate the

improvement made by cultivation from the earth itself upon which

that improvement is made, the idea of landed property arose from

that inseparable connection; but it is nevertheless true that it

is value of the improvement only, and not the earth itself, that

is individual property. Every proprietor, therefore, of cultivated

land owes to the community a ground-rent, for I know no better

term to express the idea by, for the land which he holds. …Cultivation

is one of the greatest natural improvements ever made. . . .But

the landed monopoly that began with it has dispossessed more than

half the inhabitants of every nation of their natural inheritance."

[Thomas Paine, Agrarian Justice, 1797]

|

Paley,

William

(Archdeacon of Carlisle)

ENLARGE

|

If you should see a flock of pigeons in a field of corn, and

if (instead of each picking where and what he liked, taking just

as much as it wanted and no more) you should be ninety-nine of

them gathering all they got into a heap and reserving nothing for

themselves but the chaff and refuse; keeping this heap for one,

and that the weakest, perhaps worst, pigeon of the flock; sitting

round and looking on all the winter whilst this one was devouring,

throwing about and wasting it; and if a pigeon more hardy or

hungry than the rest touched a grain of the hoard, all the others

instantly flying upon it and tearingit to pieces -- if you should

see this you would see nothing more than what is every day

practiced and established among men.

[From: Moral and Political

Philosophy (1785), Book III, Part I., Chap. 1]

|

Paley,

William

|

We now speak of property in land; and there is a difficulty in

explaining the origin of this property consistently with the law

of nature; for the land was once, no doubt, common; and the

question is, how any particular part of it oculd justly be taken

out of the common and so approprirated to the first owner as to

give him a better right to it than others; and what is more, a

right to exclude others from it. Moralists have given many

different accounts of this matter, which diversity alone, perhaps,

is a proof that none of them are satisfactory.

[From: Moral and Political

Philosophy (1785), Book III, Part I, Chap. 4]

|

Penn,

William

(1644-1718)

ENLARGE

|

One of the first to recognize the promise of ground rents as a

just source of public revenue was William Penn, the founder of

the North American colony of Pennsylvania. Penn wrote in 1682:

If all men were so far tenants to the public that the

superfluities of grain and expense (meaning "surpluses")

were applied to the exigencies thereto (meaning "community

needs"), it would put an end to taxes, leave not a beggar,

and make the greatest bank for national trade in Europe.>

[From: Reflections and Maxims, Sec. 222, Works V.,

pp. 190-1]

|

PENNSYLVANIA

ECONOMY

LEAGUE |

From a 1988 study, Revised Recovery Plan for the City of

Clairton, Pa:

... attaching different millage rates to land and buildings

will accomplish a more equitable distribution of the property tax.

|

Pettigrew,

R.F.

ENLARGE

|

From a letter written 19, July, 1917 printed in Everyman (October

1917) by R.F. Pettigrew, former U.S. Senator from the state of

South Dakota:

Tax reform has been tried since the days of Ham Arabbie who

announced it in a code of laws of Babylon 2300 years before

Christ. But the Single Tax (another name for free land) is of more

recent origin and thereis but one form of it.

|

Phelps,

William Lyon |

I am delighted to have the Anniversay edition of "Progress

and Poverty." When I was an undergraduate in college, in the

year 1998, Professor Arthur Hadley, later President Hadley,

devoted an entire course in my senior year to this book.

|

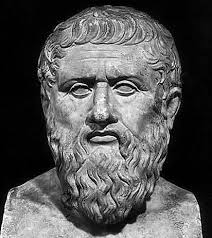

Plato

ENLARGE

|

When discord arose, then the two races were drawn different

ways; the iron and brass fell to acquiring mney and land and huses

and gold and silver; but the gold and silver races, having the

true riches in their own nature, inclined towards virtue and the

ancient order of things. There was a battle between them, and at

last they agreed to distribute their land and houses among

individual owners; and they enslaved their friends and

maintainers, whom they had formerly protected.

[From: The Republic, Jowett's

Translation, Book VIII., p.547 (words ascribed to Socrates)]

|

Pliny

(Gaius Plinus Secundus) |

It is the wide-spread domains that have been the ruin of

Italy, and soonwill be that of the provinces as well.

[From: Natural History, Book

XVIII., Chap. 7]

|

Plutarch

ENLARGE

|

To the end therefore that he might expel out of the state

arrogance and envy, luxury and crime, and those yet more

inveterate diseases of want and superfluity, he obtained of them

to renounce their properties, and to consent to a new division of

the land, and that they should live altogether on an equal

footing, -- merit to be their only road to eminence, and the

disgrace of evil, and credit of worthy acts, their one measure of

difference as between man and man.

[From: Life of Lycurgus]

|

Plummer,

W.C. |

In 1930, he held the position of Assistant Professor of

Economics, University of Pennsylvania, Philadelhia, Pennsylvania

While the right of property denotes in every state of society

the largest powers of exclusive control over wealth which the law

accords, yes, ... these powers of exclusive use and control are

various and differ greeatly in different times and places.

...Private property ... in land has always ocupied a strong

position in the United States, and continues to do so at the

present time. ...

Taxes upon land are a distinct limitation of private property

rights. Land possesses certain characteristics not found in other

classes of wealth, and for this reason it has often been regarded

as a subject for special taxes. ...The purpose of such taxes, if

they are comparatively small, is to raise revenue for the support

of the Government; but if they are very large, the predominating

purpose is usually to bring about reforms in the social system.

[From: "Limitations to Private

Property Rights in Land in the United States," The Annals

of The American Academy of Political and Social Science, Vol.

CXLVIII, No. 237, March, 1930, p.56]

|

Plummer,

W.C. |

Since the publication of Progress and Poverty in 1879 by Henry

George, in which he advocated what is known as the single tax,

there have been numerous individuals and groups who would like to

bring about radical changes in the socio-economic order by further

limiting private property rights through heavier taxes on land.

The advocates of the single tax contend that the Government should

take in taxes the entire economic rent of land, and that this

should be the only form of taxation. The use of the single tax

would mean practically the abolition of private property in land

and the substitution of community ownership. There would probably

remain the right of private possession, of alienation, and of use

for productive purposes, but the user of the land would be

compelled ot pay to society, in the form of taxes, the full

economic rent. ...Since the market value of land depends upon its

present and anticipated future income, the introduction of the

single tax would take from the present owners the equivalent of

the entire value of their land.

[From: "Limitations to Private

Property Rights in Land in the United States," The Annals

of The American Academy of Political and Social Science, Vol.

CXLVIII, No. 237, March, 1930, p.57]

|

Pollock,

Frederick

(1845-1937)

ENLARGE

|

Pollock was an English jurist, educated at Eton and Cambridge and

admitted to the bar in 1871. He became professor of jurisprudence

at Oxford in 1883, a position he retained until 1903. He devoted

After 1914 he served as judge of the admiralty court of the Cinque

Ports. His main writings included: The Principles of Contract

(1876) and the Law of Torts (1887). Pollock also served as

editor of the Law Quarterly Review from 1885 to 1919 and

editor in chief (1895–1935) of the Law Reports from

1895 to 1935. He collaborated with F. W. Maitland on The

History of English Law (1895), contributing the material on

Anglo-Saxon law.

It is commonly supposed that land belongs to its owner in the

same sense as money or a watch; this has not been the theory of

the English law since the Norman Conquest, nor has it been so in

its fullest significance at any time. No absolute ownership of

land is recognized by our law-books except in the Crown. All lands

are supposed to be held immediately or mediately of the Crown,

though no rent or services may be payable and no grant from the

Crown on record.

[From: Land Laws, Chap. I, p.

12]

|

Precy,

Monsieur V. |

In 1930, this French advocate of land value taxation wrote:

"And so it is with the greatest satisfaction that I am

able to quote here the pronouncement made by Robert Smillie, the

English miners' leader, in October 1921: 'It is only lately that I

have come to understand that the root of the whole social problem

is to be found in the land question. As long as access to land

remains forbidden to those who could put it to a useful purpose,

we shall always see crowds of men, cap in hand, at the doors of

our factories."

|

Pufendorf,

Samuel

ENLARGE

|

In prnciple I do not see why the sea should be dispensed from

serving our need and comfort, any more than the land. However ...

men were left free to make private property of the sea as well as

of the land, or to leave it in its primitive state, common to all,

so that it should not belong to one more than to another.

[From: Law of Nature and Nations

(1672), Book IV, Chap. 5, Sec. 5]

|

Pufendorf,

Samuel

|

All that natural law does is to suggest the establishment of

property when the welfare of human society demands it, leaving it

to the wisdom of men to determine whether they should allow

private property in all things or only in some, and whether they

should hold those which they appropriate separately or in common,

leaving the rest to the first occupant, so that no one can assume

the right to enjoy them alone.

[From: Law of Nature and Nations

(1672), Book IV, Chap. 4, Sec. 4]

|

Putland,

Gavin

ENLARGE

|

Gavin Putland, at the Signal Processing Research Centre,

Queensland University of Technology in Brisbane, Australia, wrote:

There is a better way to improve the competitiveness of a

country's industries: reduce taxes that are passed on in prices

and increase taxes that are not. The range of taxes that are built

into prices is wider than is generally supposed. ...Taxes on land

values, in contract, fall entirely on landowners and cannot be

passed on in prices. Landowners cannot withdraw land from use in

order to force users to pay the tax, because the withdrawn land

generates no income to cover the tax. There is no surer way to

make a country more competitive, thus protecting jobs in its

industries, than to replace taxes on labour and capital with taxes

on land values.

[From: a World Bank internet

discussion, 19 March 2000]

|

Quesnay,

Francois

ENLARGE

Turgot,

A.R. Jacques

ENLARGE

|

During the late eighteenth century in France, the school of

political economists known as the Physiocrats, which included the

royal physician, Francois Quesnay and finance minister,

A. R. Jacques Turgot , also recognized the power of

collecting ground rent for public purposes. They expressed this

thought and coined the phrase "impot unique" (i.e., "the

single tax").

... the form of assessment which is the most simple, the most

regular, the most profitable to the state, and the least

burdensome to the tax-payers, is that which is made proportionate

to and laid directly on the source of continually regenerated

wealth (land).

|

BROWSE BY AUTHOR

|

THRU

THRU